Restaurant Startup Costs Breakdown You Need

Share

So, you're dreaming of opening a restaurant. It’s an exciting thought, but let's get straight to the big question: what’s it going to cost? The truth is, there’s no single price tag. The real number can land anywhere from $175,000 to over $500,000, and sometimes even higher.

That massive range comes down to the specifics of your vision. A small, cozy café in a quiet suburb is a completely different financial ballgame than a sprawling fine-dining spot in the heart of a major city. Every choice you make, from the menu you design to the neighborhood you choose, will shape your final budget. We're here to help you discover the latest news and exclusive deals on restaurant equipment and supplies so you can stay informed about industry trends and make the smartest financial decisions.

What It Really Costs to Open Your Dream Restaurant

When you start digging into the numbers, you'll quickly see that three core factors drive the huge cost variations. Think of them as the main dials you can turn that will either raise or lower your startup expenses.

- Your Concept: Are you thinking of a quick-service taco stand or an elegant sit-down bistro? A simple concept means less complex kitchen gear and a smaller team, keeping initial costs down. A fine-dining experience, on the other hand, demands a bigger investment in specialized equipment, a larger staff, and a more sophisticated bar setup.

- The Size of Your Space: More square footage equals more expenses. It’s that simple. A larger restaurant means higher rent, more tables and chairs to buy, a bigger kitchen to outfit, and heftier utility bills every month. Every foot you add to the floor plan adds to both your startup and ongoing costs.

- Location, Location, Location: This old real estate mantra is gospel in the restaurant world. Leasing a spot in a high-traffic downtown area can cost a fortune compared to a location in a suburban shopping center. Your location also directly impacts what you’ll pay for labor and how much you'll need to spend on marketing to stand out from the competition.

Understanding the Major Expense Categories

To get a real grip on your budget, you have to break it down. Your biggest cash outflows right out of the gate will almost always be the kitchen equipment, construction or renovations for the space, furniture, your point-of-sale (POS) system, and all the necessary licenses and permits.

One of the most effective ways to manage these initial costs is to look into buying used restaurant equipment. You can often find high-quality, reliable gear for a fraction of the cost of buying new. For a clearer picture of what your build-out might cost, tools like commercial construction cost calculators can give you a solid starting point.

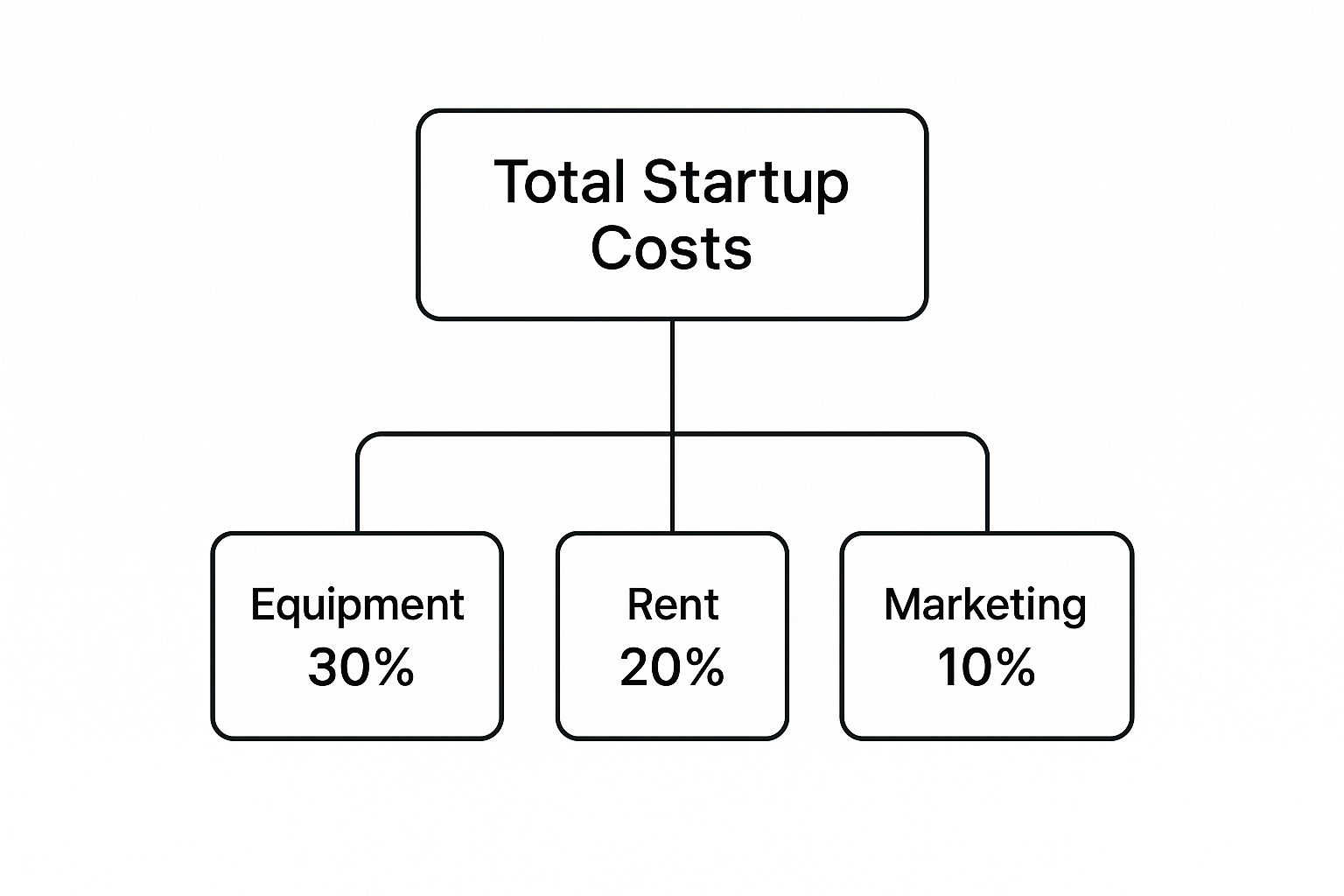

Here's a quick look at how those major costs typically stack up.

As you can see, the physical assets—the stuff you can touch and the space you operate in—are what eat up the biggest slice of the pie. We’ll walk through each of these expenses one by one to help you build a realistic financial plan from the ground up.

To give you a bird's-eye view, here's a table summarizing the typical cost ranges you can expect for each major category.

Typical Restaurant Startup Cost Ranges by Category

This table provides a high-level summary of estimated cost ranges for the major expense categories involved in opening a restaurant, giving you a quick financial overview.

| Expense Category | Low-End Estimate | High-End Estimate | Key Factors Influencing Cost |

|---|---|---|---|

| Commercial Space Lease | $2,000/month | $12,000/month | Location (city vs. suburb), square footage, local real estate market demand. |

| Licenses & Permits | $500 | $50,000+ | Liquor license costs, local health department fees, business registration complexity. |

| Kitchen & Bar Equipment | $25,000 | $150,000 | New vs. used equipment, brand quality, size of the kitchen, scope of your menu. |

| Renovations & Build-Out | $10,000 | $250,000 | Extent of construction needed, plumbing/electrical work, quality of finishes, contractor rates. |

| Furniture & Decor | $15,000 | $80,000 | Number of seats, custom vs. stock furniture, interior design complexity, quality of materials. |

| Initial Inventory | $5,000 | $25,000 | Menu size and complexity, quality of ingredients, initial bar stock (liquor, wine, beer). |

| Technology (POS System) | $1,200 | $20,000 | Number of terminals, software subscription model vs. one-time purchase, hardware included. |

| Marketing & Grand Opening | $2,000 | $30,000 | Scope of pre-opening buzz, digital advertising spend, public relations, event costs. |

| Working Capital (3-6 Months) | $20,000 | $100,000 | Covers unforeseen expenses, payroll, and operating costs before the restaurant becomes profitable. |

Keep in mind that these are just estimates. Your actual costs will depend entirely on your specific project, but this breakdown gives you a solid framework for building your own detailed budget.

Securing and Building Your Restaurant Space

Your restaurant's location is so much more than an address on a map—it's one of the biggest line items in your entire startup budget. This is where your dream takes physical form, and the costs to secure and build it out can make or break your whole financial plan. These expenses run far deeper than just monthly rent; we're talking about everything from hefty security deposits to the massive costs of construction and renovation.

Think of it like buying a car. You could get a fully-loaded, certified pre-owned vehicle that just needs a good detail (that's your 'second-generation' space). Or, you could buy a bare chassis and an engine, knowing you have to build the rest of the car yourself (that's a 'grey box' or 'vanilla shell'). The initial investment and the sheer amount of work required are worlds apart.

The Tale of Two Spaces: Second-Generation vs. Grey Box

Getting a handle on the difference between these two common types of commercial space is absolutely critical for managing your budget. A second-generation restaurant is a spot that used to be another food service business. This is your "certified pre-owned" option.

So why can this be such a game-changer for your bottom line?

- Existing Infrastructure: It often comes with the essential—and expensive—systems already installed. We're talking commercial kitchen hoods, grease traps, walk-in coolers, and the right plumbing and gas lines.

- Reduced Build-Out: Since the basic layout is already designed for a restaurant, you'll spend far less on major construction. Your focus shifts to cosmetic updates rather than foundational work.

- Faster Opening: Less construction means a much quicker path to opening your doors and, most importantly, making money.

On the flip side, a grey box is a completely blank slate. It’s an empty commercial space with unfinished floors, bare walls, and only the most basic utility hookups. While it gives you total creative freedom, that freedom comes at a steep price. You'll be on the hook for installing every single element from scratch, from the kitchen plumbing to the dining room lighting.

The decision between a second-generation space and a grey box can mean a cost difference of $50,000 to over $200,000. While a grey box offers total customization, the savings from a second-gen spot can be pumped back into other vital areas like marketing or working capital.

Deconstructing Build-Out and Renovation Costs

Whether you're just making a few tweaks or doing a full-blown build-out, renovation costs are going to be a huge chunk of your budget. This is the phase that turns an empty room into a functional, compliant, and inviting restaurant. The process pulls in architects, designers, and various contractors, and every one of them adds to the final bill.

When building out your restaurant, finding an experienced commercial electrical contractor is essential for all your power and wiring needs, from the kitchen to the dining area.

Here are the main cost drivers you need to plan for:

- Architectural & Design Fees: You need professionals to create blueprints that are not only beautiful but also compliant with all local codes.

- Plumbing & Electrical Work: Commercial kitchens have intense power and water demands that often require major upgrades to a building's existing systems.

- HVAC Systems: Proper ventilation, especially for the kitchen, is a non-negotiable and costly requirement.

- Construction & Finishes: This is everything from framing walls and laying floors to painting and installing light fixtures.

- Permitting & Inspection Fees: Your local authorities will need to approve your plans and inspect the work along the way, and each step comes with a fee.

A well-designed space is about more than just looks; it's about making your operation run smoothly. For tips on optimizing your back-of-house, you can find great insights on https://encoreseattle.com/blogs/seattle-restaurant-equipment/commercial-kitchen-design-layout to make sure your space works as hard as you do.

Remember to vet contractor quotes carefully and, most importantly, build a contingency fund of at least 15-20% for those inevitable, unexpected construction surprises. It's the key to keeping this massive investment on track.

Equipping Your Kitchen and Dining Room

Once you’ve signed the lease and have the keys in hand, the real fun begins: filling that empty space. This is where your restaurant truly starts to take shape, and it’s a massive slice of your startup budget. You’re not just buying stuff; you're building a highly specialized toolkit, with every single item—from the industrial oven to the salt shakers—playing a critical role.

The price tag for all this? It can swing wildly. Expect to spend anywhere from $25,000 for a small, lean setup to well over $150,000 for a larger, full-service restaurant. Your menu is the blueprint for your kitchen needs, while your brand vision and seat count will dictate what you spend on the dining room. Staying informed about the latest trends in restaurant equipment and supplies can help you find deals and make smarter purchasing decisions.

Back of House: The Engine Room

Let's be clear: your kitchen is the heart and soul of your operation. This is where you make your money, and outfitting it correctly is a major investment. The equipment has to be tough, efficient, and ready for the nightly rush. Trying to save a few bucks on a cheap oven or fridge is a recipe for disaster—it almost always leads to service bottlenecks and expensive emergency repairs.

Here are the non-negotiables for your back-of-house (BOH):

- Cooking Equipment: This is your production line. Think ranges, ovens (convection is a workhorse, combi ovens are incredibly versatile), grills, griddles, and fryers. What you need is driven entirely by what you plan to cook.

- Refrigeration: You can't operate without it. Walk-in coolers and freezers are essential for bulk storage. You’ll also need smaller reach-in units at key prep stations so your line cooks aren't constantly running to the back.

- Food Prep Equipment: This is all about consistency and speed. We're talking stainless steel work tables, heavy-duty mixers, food processors, slicers, and plenty of cutting boards.

- Storage and Shelving: Health inspectors love to see proper storage. NSF-rated shelving is a must for organizing dry goods, cookware, and small appliances.

- Dishwashing Station: A high-temp commercial dishwasher, a three-compartment sink, and sturdy drying racks are the unsung heroes of a busy restaurant. They keep you from running out of clean plates mid-service.

Trying to remember every single item can be a headache. To make sure you don't miss anything crucial, it helps to follow a detailed commercial kitchen equipment checklist that breaks down every station from prep to the service line.

Front of House: Creating the Experience

Your dining room is your stage. It’s where guests connect with your brand, and every detail matters. The furniture, decor, and technology all work together to craft an atmosphere that makes people want to stay—and come back. This isn’t just about putting chairs at tables; it's about building a vibe.

Key investments for your front-of-house (FOH) include:

- Furniture: Tables, chairs, booths, and barstools are the bones of your dining room. Expect to budget between $15,000 and $80,000 here, depending on how many seats you have and the style you're going for.

- POS System: Your Point of Sale system is the command center for your FOH. A simple, tablet-based setup might start around $1,200, while a sophisticated, multi-terminal system can easily exceed $20,000.

- Tableware and Glassware: All those plates, bowls, forks, and glasses add up fast. Remember to order enough to cover a full turn of the dining room, plus extra to account for inevitable breakage.

- Linens: Whether it's crisp tablecloths, cloth napkins, or professional staff uniforms, linens add a layer of polish and professionalism to the guest experience.

Choosing Your Equipment: New vs. Used vs. Leasing

How you get your equipment is one of the most important financial decisions you'll make. This choice directly impacts your upfront cash needs and your long-term costs. There's no single right answer; it all depends on your budget and business strategy.

Your equipment acquisition strategy is a powerful lever in your financial plan. Choosing to lease a $15,000 combi oven instead of buying it new could free up critical cash for your grand opening marketing push or simply give you a much-needed cash cushion.

Let’s break down the pros and cons of each path.

Choosing Your Equipment: New vs Used vs Leasing

Deciding whether to buy new, hunt for used deals, or lease your equipment is a classic restaurant startup dilemma. This table weighs the key factors to help you figure out the smartest move for your financial situation.

| Acquisition Method | Upfront Cost | Long-Term Value | Maintenance Responsibility | Best For |

|---|---|---|---|---|

| Buying New | Highest | High (it's your asset) | You (but comes with a warranty) | Well-funded startups or established owners focused on building long-term assets. |

| Buying Used | Low | Medium | You (no warranty, so it's a gamble) | Bootstrappers and budget-conscious owners willing to accept some risk for big savings. |

| Leasing | Lowest | None (you're just renting) | The leasing company (often included) | New startups with limited capital who need to protect their cash flow at all costs. |

Ultimately, many smart operators find a middle ground. A hybrid approach—buying critical, high-use items new (like your main oven and walk-in) while sourcing secondary pieces from restaurant auctions or reputable used dealers—often provides the best balance of cost, reliability, and long-term value.

Sorting Out Licenses, Permits, and Legal Fees

Beyond the shiny new ovens and perfectly set tables, there's a whole world of paperwork that's absolutely critical to getting your doors open. It's easy to get bogged down in the red tape, but think of these fees as the foundation of your business—they make everything you build on top of it legal, safe, and secure.

The cost for all this can swing wildly, from just a few hundred dollars to tens of thousands. What's the biggest factor? Your location and whether you're pouring drinks. A tiny coffee shop in a small town might only need $500 for basic permits. But a full-service bar in a big city? You could be looking at over $50,000, with most of that going toward the liquor license alone.

Your Essential Paperwork Checklist

Before you can serve a single customer, you’ll need to get a few key documents in order. Each one has a specific job, from protecting public health to making sure you're paying the right taxes. They all come with their own application and, of course, a fee.

Here are the non-negotiables you'll almost certainly need:

- Business License: This is the green light from your city or county saying you're officially allowed to operate. The cost is often tied to how much revenue you expect to make.

- Food Service Permit: Your local health department issues this one. It’s their stamp of approval that you meet all the required sanitation and food safety rules. Get ready for inspections!

- Certificate of Occupancy: This proves your building is safe for people to be in and meets all the local building codes. You literally can't have customers inside without it.

The real wild card here is the liquor license. In some areas, you might get one for a few thousand dollars. In others, where licenses are scarce, they can be sold privately for hundreds of thousands. It's a huge variable in your budget.

Why You Shouldn't Skip Professional Help

I know it’s tempting to save money by handling all the legal and financial stuff yourself, but hiring a lawyer and an accountant from the get-go is one of the smartest moves you can make. Don't think of it as an extra cost—build it into your startup budget from day one. Trust me, it can save you from massive headaches later.

Think of legal and accounting fees as your business's insurance policy. Spending a few thousand dollars upfront to correctly form an LLC (Limited Liability Company) or S-Corp can protect your personal assets if the business ever faces a lawsuit—a shield that is priceless.

A good lawyer will help you make sense of your lease and choose the right business structure. A sharp accountant will make sure your books are set up correctly from the start. Taking care of compliance and legal details isn't just about playing by the rules; it's about building a strong, resilient business that's ready for anything.

Budgeting for Your Team and Opening Operations

So far, we've talked a lot about the big, one-time purchases—the shiny new equipment and the cost of building out your space. But now we need to shift gears and talk about a totally different kind of investment: your people and the cash you'll need just to get the doors open. The payroll clock starts ticking long before your first customer ever sees a menu, so this is a part of the budget you absolutely have to nail.

Here, we’ll get into the costs of hiring and training your staff before you open. We'll also break down the all-important concept of working capital—the money that keeps the lights on while you’re getting on your feet. Think of it like the fuel in the tank; even the most incredible restaurant won't make it off the lot without it.

Pre-Opening Payroll and Hiring Costs

Your team is the heart and soul of your restaurant, but bringing that team together isn't free. This isn't just about their wages for the first week of service; it covers everything it takes to find, vet, and train a crew that's ready to shine on day one.

These initial labor expenses usually look something like this:

- Recruitment Ads: Getting the word out on industry job boards or social media to find the right people.

- Background Checks: An essential step, especially for anyone in management or handling cash.

- Onboarding Materials: The little things that add up, like employee handbooks, uniforms, and other new-hire gear.

- Training Wages: This is a big one. You have to pay your staff for the weeks they spend learning your menu, your point-of-sale system, and your service standards—all before a single dollar of revenue comes in.

As a rule of thumb, it’s smart to budget for 2-4 weeks of training payroll. Investing this money upfront is what ensures your team can bring your vision to life perfectly from the moment you open.

The Power of Working Capital

What happens when your first truckload of fresh produce shows up, but you haven't sold a single salad yet? How do you pay your cooks and servers after the grand opening buzz dies down but before your cash flow is steady? The answer is working capital.

Simply put, working capital is the cash reserve you keep on hand to cover all your operating expenses for the first few months. It's your financial safety net, bridging the gap between spending money and making money. It’s what pays for that first big inventory order, covers the first few payroll cycles, and keeps the utilities from getting shut off.

Think of working capital as your restaurant's runway. A plane needs a long stretch of pavement to build up speed before it can take off. Your working capital is that runway—it gives your business the time and resources it needs to get airborne financially.

Without enough working capital, one unexpected repair bill or a slower-than-hoped-for first month could put you in a serious bind. That's why most industry pros recommend having at least 3 to 6 months of operating expenses stashed away.

Navigating Rising Labor and Operational Costs

When you're building your initial budget, you can't ignore what's happening in the real world. Right now, operational costs—especially labor and food—are a massive challenge for restaurant owners. The latest data shows a staggering 85% of restaurateurs have seen their payrolls increase, with labor costs climbing by about 10% monthly since April 2021.

On top of that, over 30% of restaurants say that just finding and keeping good staff is their number one operational headache. You can see more insights on these trends at TRNUSA.com. This all means you’ll likely have to offer competitive wages to attract the talent you need.

Factoring these market realities into your startup budget isn't just a good idea; it's essential. A solid budget anticipates these pressures, making sure you have the money to build a skilled, motivated team that can not only survive the chaotic opening phase but also drive your restaurant's success for years to come.

Getting the Money: How to Fund Your Restaurant and Plan for Success

You've done the hard work of mapping out every single cost. You know your numbers inside and out. But that's only half the battle. Now comes the part where you get the actual capital to turn that meticulously planned budget into a real, breathing restaurant.

This is where your business plan becomes your most important tool. Don't think of it as just a stuffy document for a banker's dusty shelf. It's your sales pitch—the story you tell lenders and investors to convince them that your concept isn't just a good idea, but a profitable one. It needs to be packed with realistic financial projections, a deep dive into your local market, and a clear, compelling vision for what makes your place special.

Exploring Your Financing Options

With a polished business plan in hand, it's time to go find the money. Very few restaurant owners get their funding from a single source. Most patch it together from a few different places, and it pays to know the pros and cons of each.

Here are the most common paths people take:

- Traditional Bank Loans: These usually have the best interest rates, but banks are famously cautious. You’ll need a great credit score and be prepared to put up significant collateral.

- SBA Loans: These are a fantastic option for new entrepreneurs. Because they're backed by the Small Business Administration, they feel less risky to lenders, making them a bit easier to get.

- Private Investors: This could be anyone from your well-off uncle to a professional angel investor. They give you cash in exchange for a piece of the pie—equity in your business. Just be sure you're ready to give up some ownership and control.

- Crowdfunding: Platforms like Kickstarter or GoFundMe can be a creative way to raise money. You're not just getting funds; you're building a base of loyal, excited customers before you even open your doors.

Don't Forget Your "Oops" Fund

No matter how perfect your spreadsheet is, I can promise you one thing: something will go wrong. A pipe will burst, a permit will get delayed, or your brand-new oven will decide to die on day two. These things happen, and they will absolutely wreck a tight budget. That’s why a contingency fund isn't just a nice-to-have; it's a must-have.

Think of your contingency fund as your restaurant's financial safety net. It's not just "extra" money; it's a planned buffer designed to absorb the shocks that will inevitably come. You should aim to set aside 15-20% of your total startup budget just for these surprises.

The global restaurant industry is a behemoth, valued at around $4.03 trillion and expected to grow to $6.81 trillion by 2032. While that shows incredible opportunity, it also means the competition is fierce and the cost of entry is high. You can dive deeper into these global restaurant industry trends on Restroworks.com. Having that financial cushion is what allows you to handle the unexpected without draining your daily operating cash or, worse, stalling your grand opening.

Common Questions About Restaurant Startup Costs

Let's be honest, figuring out the finances for a new restaurant can feel overwhelming. You’ve probably got a million questions running through your head. Here are some of the ones we hear most often, with straight-to-the-point answers based on real-world experience.

What Are the Most Common Hidden Costs?

Even the most detailed business plan can miss a few things. New owners are often blindsided by expenses that never made it onto the initial spreadsheet. Think hefty security deposits for your gas and electricity, or the sudden plumbing crisis that blows your construction budget.

You also have to account for the cost of initial food inventory that gets used (and sometimes wasted) during staff training. On top of that, recurring service fees for essentials like trash removal, grease trap cleaning, and pest control can pile up faster than you'd expect.

The only way to handle these curveballs is to plan for them. A contingency fund isn't just a nice idea—it's essential. Aim to set aside an extra 15-20% of your total startup budget. You’ll be glad you did.

How Long Until a New Restaurant Is Profitable?

This is the big one, isn't it? While everyone's path is different, it's extremely rare for a restaurant to turn a profit in its first year. The industry average for reaching consistent profitability is somewhere between two and five years.

Getting there depends on so many moving parts: the foot traffic in your location, how well your concept resonates with the community, your marketing savvy, and—most importantly—your ability to keep a death grip on food and labor costs right from the start.

Food Truck vs. Restaurant: What Is the Cost Difference?

A food truck is a much more accessible entry point into the food business. You’re typically looking at startup costs between $50,000 and $150,000. The biggest ticket items are the truck itself and squeezing a functional kitchen into it, but you get to skip the biggest expense of all: a long-term commercial lease.

On the other hand, opening a traditional brick-and-mortar restaurant is a whole different ballgame. Costs usually start around $175,000 and can easily climb past $500,000. The huge price jump comes from expensive leases, major renovations, property taxes, larger staff payrolls, and all the furniture and decor needed to fill the space.

Is Buying an Existing Restaurant Cheaper?

It can be a fantastic shortcut, but you have to do your homework. Taking over an existing spot can save you a mountain of time and cash since the kitchen is already built, the equipment is in place, and the permits are sorted.

But there's a flip side. You could be inheriting a boatload of problems. Maybe the place has a terrible reputation, the walk-in freezer is on its last legs, or you’re stuck with a terrible lease agreement for the next five years. You absolutely have to perform deep due diligence to figure out if you're getting a bargain or buying someone else's nightmare.

Planning your restaurant's kitchen is a huge step, and getting the right equipment at the right price is essential. At Encore Seattle Restaurant Equipment, we help chefs and restaurant owners discover exclusive deals and stay informed on industry trends. We offer premium new and used equipment to help you build your dream kitchen without breaking the bank. Explore our inventory and get expert advice at https://encoreseattle.com.