Boost Profits with a Restaurant Profit Margin Calculator

Share

Knowing your restaurant's profit margin is like having a financial GPS. It's a simple percentage that cuts through all the noise of sales figures and expense reports to tell you exactly how much of every dollar you earn is actual profit. For most restaurants, this magic number lands somewhere between 2% and 6%.

Your Restaurant's Financial Health at a Glance

High sales numbers can feel great, but they don’t always mean your business is thriving. I've seen plenty of busy restaurants barely breaking even because they didn't have a firm grip on their profitability. This is where your profit margin becomes your most important tool for making smart, strategic decisions.

To really understand your restaurant's financial pulse, you need to track two key metrics: gross profit margin and net profit margin. Each one tells a different, but equally vital, part of your financial story.

Gross vs. Net Profit Margin

Think of your gross profit margin as the profitability of your menu, pure and simple. It’s what’s left over from each dish sold after you've paid for the ingredients—what we call the Cost of Goods Sold (COGS). A healthy gross margin, often hovering around 70%, is a great sign that you’re pricing your menu effectively.

Your net profit margin, however, is the real bottom line. This is the cash you have left after all the bills are paid. We’re talking about everything: labor, rent, utilities, marketing, and all the crucial gear that keeps your kitchen humming. Getting your kitchen set up is a massive investment, which is why working from a solid commercial kitchen equipment checklist is so important for managing those big-ticket costs from day one.

Key Takeaway: You can't just track one. Gross margin tells you if your menu is profitable. Net margin tells you if your entire business is profitable. Looking at one without the other only gives you half the story.

Globally, the average restaurant profit margin sits between 2% and 6%, but this can swing wildly depending on your concept. A full-service spot with higher labor costs might be on the lower end, while a lean quick-service restaurant could see much higher margins thanks to streamlined operations.

To get a complete picture, it's also helpful to understand how to calculate financial ratios more broadly. These metrics are the foundation for turning raw numbers into real, money-making strategies for your restaurant.

Before we dive into the formulas, let's quickly break down the key terms you'll be working with. Think of this as your financial cheat sheet.

Key Profitability Metrics At a Glance

| Metric | What It Measures | Why It Matters for Your Restaurant |

|---|---|---|

| Revenue | The total amount of money generated from all sales. | This is your top-line number, showing how much cash is coming in before any expenses are paid. |

| COGS | The direct costs of producing your menu items (food, beverages). | This helps you understand menu item profitability and control inventory costs effectively. |

| Gross Profit | Revenue minus COGS. | This shows the profit made from your core product (your menu) before overhead is considered. |

| Net Profit | The final profit after all expenses are deducted from revenue. | This is your true bottom line—the ultimate measure of your restaurant's overall success. |

Having these definitions clear in your mind makes the next steps much easier. Now you're ready to start crunching the numbers.

Calculating Your Gross Profit Margin

Alright, let's get our hands dirty and figure out your gross profit margin. This is one of the most important numbers for your restaurant because it tells you exactly how much money you're making from your menu before a single dollar goes to paying staff, rent, or the electricity bill.

To get there, we first need to nail down your Cost of Goods Sold (COGS).

Getting your COGS right means you've got to be meticulous. It's not just the big-ticket items like steak or salmon; it's the pinch of saffron, the splash of cooking oil, and every single garnish. Solid inventory management is non-negotiable here—you have to account for waste and spoilage to avoid kidding yourself about your actual costs.

The Gross Profit Formula

The math itself is pretty simple. For any given period—say, a month—you just need two figures: your Total Revenue and your COGS.

Here’s the formula:

Gross Profit Margin = [(Total Revenue - COGS) / Total Revenue] x 100

This spits out a percentage, which is way more useful for comparing performance over time than just looking at a raw dollar amount. For most restaurants, a healthy gross profit margin lands somewhere around 70%.

Let's run through a quick example. Picture a popular bistro that brought in $50,000 in revenue last month. They did their homework, counted inventory, and tracked all their food and drink purchases, landing on a COGS of $15,000.

- Gross Profit: $50,000 (Revenue) - $15,000 (COGS) = $35,000

- Gross Profit Margin: ($35,000 / $50,000) x 100 = 70%

What does this 70% mean? It tells the owner that for every dollar that comes in the door, 70 cents are left to cover all other operating expenses and, hopefully, turn into profit.

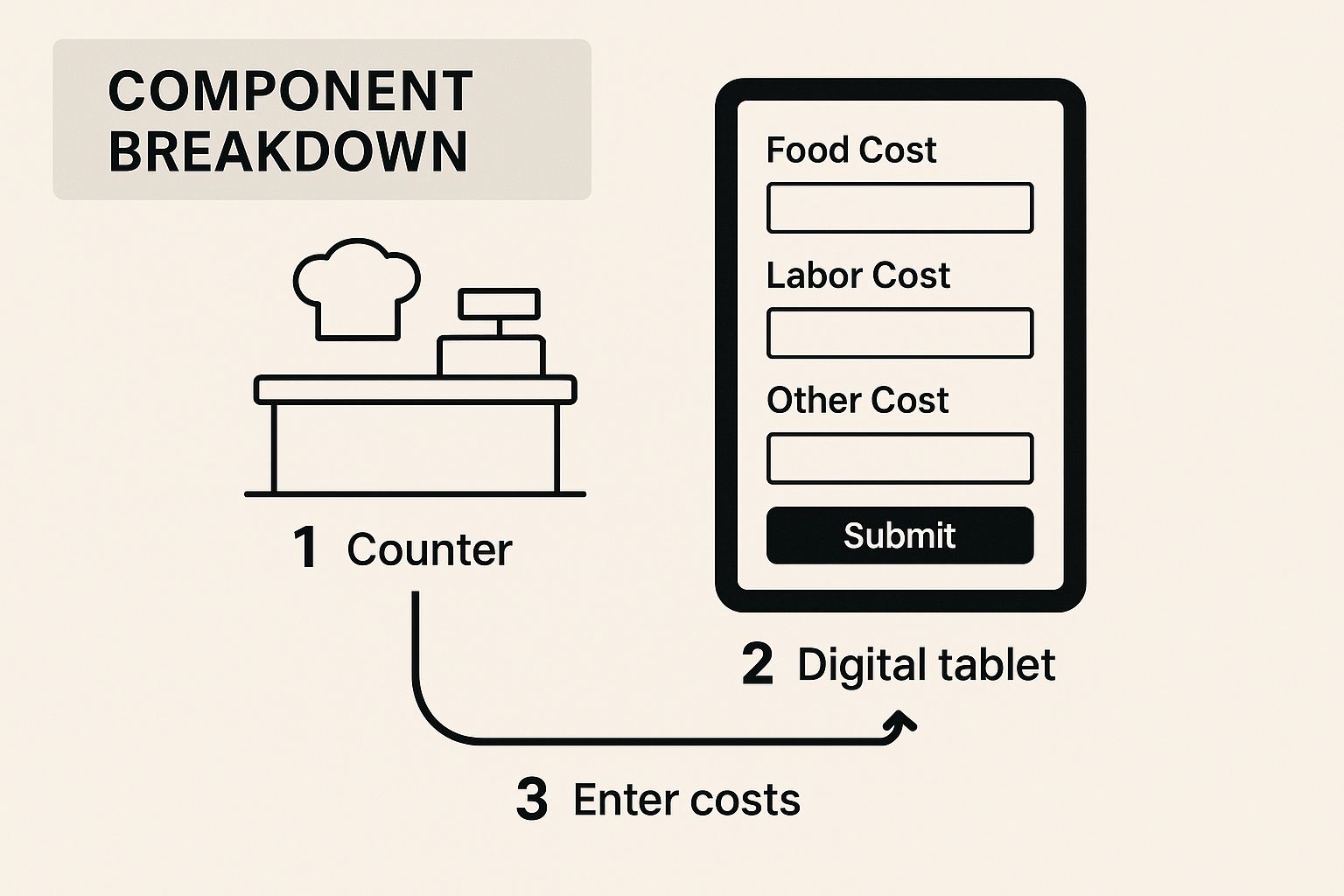

This visual gives a great breakdown of how you can input all your ingredient costs to get an accurate calculation.

As you can see, getting granular with every component cost is what leads to a precise COGS and a trustworthy profit margin. If you want to get really comfortable with the mechanics behind these numbers, it’s worth the time to master margin calculations in Excel. This first step is the foundation for truly understanding your menu's financial health.

Calculating Your Net Profit Margin

If gross margin shows your menu's potential, net profit margin is your reality check. This number is the ultimate scorecard for your restaurant's health. It’s what’s actually left in the bank after every single bill—from the big ones like rent to the small, nagging ones—has been paid.

Think of it this way: net profit gives you an unfiltered view of how much of each dollar earned actually stays in your business. To get there, you need to subtract all your operating costs from your gross profit. This is where many restaurateurs get tripped up; it’s easy to forget the less obvious expenses that can quietly sabotage your bottom line.

Don't Forget a Single Operating Cost

Take a minute and think about every single service, subscription, and utility you pay for. These are your operating expenses, and they add up faster than you’d think. Being meticulous here is non-negotiable.

I've seen many owners miss these common costs, which throws their entire calculation off:

- Credit Card Processing Fees: It's a small percentage, sure, but on tens of thousands in sales, it becomes a major expense.

- Software & Subscriptions: Your POS system, reservation platform, payroll software, and even your music streaming service all have a monthly fee.

- Utilities & Insurance: It's not just rent. You've got electricity, gas, water, trash removal, and a whole suite of insurance policies.

- Professional Services: Don't forget what you pay your accountant, lawyer, or any consultants you bring in.

- Repairs & Maintenance: Things break. A leaky faucet, a broken walk-in compressor—these costs are part of running a restaurant.

- Linens & Cleaning: If you outsource your laundry or have a nightly cleaning crew, those are operating expenses.

For your net profit figure to be accurate, you absolutely have to account for every single one of these items. This is the only way a restaurant profit margin calculator will give you a number you can actually rely on.

Putting the Net Profit Formula to Work

Once you have your gross profit figure and a complete, honest list of all your operating expenses, the math is pretty simple.

Net Profit Margin = [(Gross Profit - Operating Expenses) / Total Revenue] x 100

Let's go back to our bistro example. They had $50,000 in total revenue and a gross profit of $35,000. After tallying everything up, their operating expenses for the month came to $27,000. This included labor ($15,000), rent ($5,000), utilities ($2,000), marketing ($1,000), and other miscellaneous costs ($4,000).

Here’s how the calculation shakes out:

- First, find the net profit: $35,000 (Gross Profit) - $27,000 (Operating Expenses) = $8,000

- Now, calculate the margin: ($8,000 / $50,000) x 100 = 16%

That 16% is the golden number. It tells the bistro owner that after every cost is covered, 16 cents of every dollar in sales is pure profit. Frankly, that's an incredibly healthy margin and shows they have a tight grip on both their menu pricing and their day-to-day spending.

Actionable Strategies to Improve Your Profit Margins

Knowing your profit margin is one thing; actually improving it is where the real work begins. Once you have a handle on the numbers, you can stop guessing and start making targeted changes that genuinely fatten up your bottom line. It's time to turn that data into dollars.

The single most powerful lever you can pull is menu engineering. This goes way beyond just making food taste good. It's the art and science of analyzing every item's profitability and popularity to design a menu that sells itself. You'll quickly find your "stars"—the high-profit, high-popularity items you should be promoting—and your "duds" that are secretly eating away at your profits.

Fine-Tuning Your Operations

Look beyond the menu, and you'll find opportunities for savings everywhere. Building solid relationships with your suppliers, for example, can open the door to better pricing. Don't be shy about negotiating discounts for bulk orders or shopping around for better deals on key ingredients. A small drop in your Cost of Goods Sold can make a huge difference.

Sharp restaurant operation management is also crucial for keeping costs in check. Simple things like a strict first-in, first-out (FIFO) inventory system and consistent portion control can dramatically reduce food waste, a notorious profit killer in this business. For a deeper dive, check out our guide on how to improve your restaurant's operational flow.

The global foodservice market is on track to hit over $4.1 trillion by 2033, yet most restaurants scrape by on razor-thin net profit margins of just 3% to 5%. This unforgiving reality means every single efficiency you create matters.

A Pro Tip: Your labor costs are a huge variable you can control. Use your point-of-sale data to build smarter schedules. Stop overstaffing during lulls and make sure you’re ready for the rush. It’s a balancing act, but getting it right protects both your payroll and your customer experience.

Profit Margin Improvement Strategies

To give you a clearer picture, here’s a breakdown of common strategies and what you can realistically expect from them.

| Strategy | Area of Impact | Potential Profit Lift | Implementation Effort |

|---|---|---|---|

| Menu Engineering | COGS / Sales Mix | High (5-15%) | Medium |

| Supplier Negotiation | COGS | Medium (2-5%) | Medium |

| Portion Control | Food Waste / COGS | Medium (3-7%) | Low to Medium |

| Smart Scheduling | Labor Costs | High (5-10%) | Medium |

| Marketing & SEO | Top-Line Revenue | High (Varies) | High |

Each of these tactics requires a different level of effort, but they all push your numbers in the right direction. Starting with low-effort, high-impact changes like portion control can give you a quick win.

Finally, remember that you can't just cut your way to success. Boosting profit is also about driving more sales. Smart marketing, especially effective local SEO strategies for restaurants, gets more people in the door. When you combine tight cost controls with a steady stream of new customers, you've got a winning formula for a healthier, more profitable restaurant.

Navigating External Factors That Impact Your Bottom Line

No restaurant exists in a bubble, no matter how well you run your kitchen. Your profit margin is always being pushed and pulled by outside forces—things like economic hiccups and what your customers are craving. Getting a handle on these trends is what separates a resilient restaurant from one that gets caught off guard.

Inflation is probably the biggest headache for most operators right now. When the price of everything from cooking oil to your star produce goes up, your Cost of Goods Sold (COGS) follows suit, and that eats directly into your profits. This is why you can't afford to "set it and forget it" with your suppliers or your menu prices. You have to stay vigilant.

Responding to Market and Consumer Trends

Beyond just rising costs, you have to watch how your customers are behaving. Economic uncertainty changes spending habits in a big way. For instance, recent data from the latest restaurant report on Squareup.com shows that average tipping percentages are starting to dip.

That might seem small, but since tips can account for nearly 23% of a restaurant worker's income, it can really mess with staff morale and retention. That's a direct hit to your operational stability.

These shifts in the market are a wake-up call to be more agile. Take the lasting demand for takeout and delivery—it's not just a trend anymore. If you haven't optimized your off-premise game, you're leaving money on the table and falling behind.

Staying ahead means making smart, proactive moves. Maybe that’s re-engineering your menu to highlight dishes with more predictable food costs or investing in new tech to speed up your kitchen. Even something as basic as regular commercial kitchen equipment maintenance can save you from a catastrophic breakdown during a Saturday night rush.

By anticipating these external pressures instead of just reacting to them, you put yourself back in control of your restaurant's financial future.

Common Questions About Restaurant Profit Margins

When you're running a restaurant, the same financial questions tend to pop up again and again. Getting clear, straightforward answers is the key to moving from confusion to confident action. Let's dig into some of the most frequent queries we hear from chefs and owners.

What Is a Good Profit Margin for a Restaurant?

This is the big one, and the honest answer is: it depends on your specific concept. For most full-service restaurants, a net profit margin of 3-5% is considered healthy and sustainable. If you’re consistently hitting 10% or more, you're doing exceptionally well.

That said, different restaurant models have different benchmarks:

- Quick-service restaurants (QSRs) often see higher margins, typically in the 6-9% range, thanks to lower overhead and labor costs.

- Full-service dining usually lands somewhere between 2-4% because of the higher expenses that come with more staff and complex operations.

Ultimately, the most important goal isn't just hitting a specific number, but consistently improving upon your own past performance.

How Often Should I Calculate Profit Margins?

The short answer: monthly. This cadence gives you a regular, reliable pulse on your restaurant's financial health. It’s frequent enough to spot negative trends early and make strategic adjustments before small problems snowball into big ones.

For even tighter control, many successful operators I know track their prime costs—food and labor—on a weekly basis.

A common mistake is only running the numbers once a year for tax season. By then, it's far too late to fix the issues that have been quietly draining your profits for months. A good restaurant profit margin calculator can make these monthly check-ins quick and painless.

Another frequent error is using inaccurate data for your Cost of Goods Sold (COGS). It's easy to forget to account for things like staff meals, spoilage, or comped dishes. Similarly, overlooking "hidden" expenses like software subscriptions and routine maintenance will give you a false sense of security. Always focus on the net margin—it’s the only number that shows what you actually take home.

At Encore Seattle Restaurant Equipment, we help restaurant owners and chefs discover the latest news and exclusive deals on restaurant equipment and supplies. Stay informed about industry trends to run an efficient, profitable kitchen. Discover how we can help boost your bottom line today at https://encoreseattle.com.