A Modern Restaurant Operating Costs Breakdown

Share

When you peel back the layers of a restaurant's finances, you'll find that the biggest chunks of your budget are almost always food and labor. These two combine to form what we call "prime cost," and they're followed closely by overhead like your rent and utility bills. Getting a handle on these categories isn't just good practice—it's the first real step toward building a profitable business in this tough industry.

Your Guide to Restaurant Financial Health

Think of your restaurant's finances as the engine in a high-performance car. To get the best performance, you need to know exactly how every part works, from the fuel you put in to how the gears shift. This guide is your owner's manual for that engine, breaking down the operating costs that keep your business running day in and day out.

This isn't just about number-crunching for your accountant. It’s about gaining the strategic control you need to thrive when profit margins are notoriously thin. While the global restaurant industry is massive—projected to hit $4.03 trillion by 2025—the average profit margin for an individual spot can be as low as 3% to 5%. To really understand your own restaurant operating costs breakdown, you have to track business expenses the right way; otherwise, you're flying blind.

The Three Pillars of Restaurant Costs

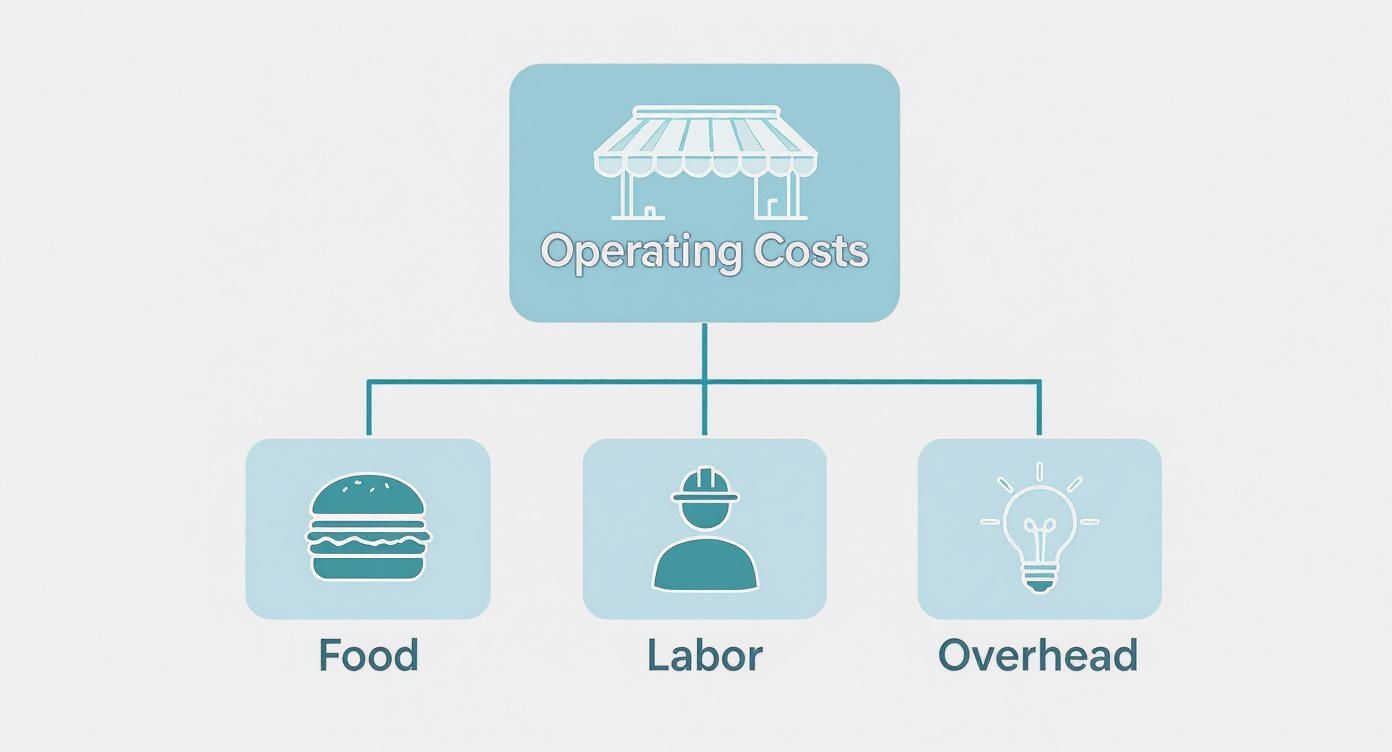

At its heart, your financial engine is built on three core components. Master these, and you've laid the foundation for a successful operation.

- Food and Beverage Costs: This is what you spend on every single ingredient and drink that goes out to a customer. It’s a variable cost, meaning it goes up and down with your sales.

- Labor Costs: This covers everything you pay your people—wages, salaries, payroll taxes, and benefits for everyone from your head chef to your bussers.

- Overhead and Occupancy: These are the fixed, predictable costs of just being open. Think rent, utilities, insurance, marketing campaigns, and software subscriptions.

This infographic gives a great visual of how these costs all fit together.

As you can see, food and labor are the two heavy hitters. They’re also the areas where smart management can have the biggest impact on your bottom line.

Introducing Your Most Important Number

Out of all the metrics you’ll track, one stands above the rest: your prime cost. It’s a simple calculation—just add your total food and beverage costs to your total labor costs.

Prime Cost = (Cost of Goods Sold) + (Total Labor Cost)

This number is the single best indicator of your restaurant's day-to-day financial efficiency. For most healthy, successful restaurants, the prime cost should land somewhere between 55% and 65% of total sales.

If you stick with us through this guide, you’ll walk away with a clear, actionable plan to tackle each of these costs, get your prime cost in line, and build a more resilient and profitable restaurant. We'll also help you stay informed on industry trends and deals on the equipment and supplies you need to succeed.

Mastering Your Food and Beverage Costs

Let’s get right to the heart of your kitchen’s finances: the Cost of Goods Sold, or COGS. This isn’t just some line item on a spreadsheet; it’s the real-world cost of every onion, every bag of flour, and every bottle of wine that comes through your door. Getting a firm grip on your COGS is the first and most critical step toward building a profitable restaurant.

Think of your food and beverage costs as the fuel for your restaurant's engine. If you're too skimpy, you’ll sacrifice quality and your engine will sputter. But if you spend too much, you’ll burn through cash without getting very far. The goal is to find that sweet spot for maximum efficiency and power.

Calculating Your Food Cost Percentage

You can't control what you don't measure. The single most important metric here is your food cost percentage, which tells you exactly how much of your revenue is being spent on the ingredients you sell. It’s a simple calculation that gives you an instant snapshot of your menu's financial health.

Food Cost Percentage = (Cost of Goods Sold / Total Food Sales) x 100

Let's walk through a quick example. Say you start the month with $10,000 in food inventory. You purchase another $8,000 in ingredients throughout the month, and when you take inventory again at the end, you have $7,000 left. Your COGS for that month is $11,000. If your total food sales were $35,000, your food cost percentage would be 31.4%. Tracking this number weekly or at least monthly is non-negotiable.

Strategic Menu Engineering and Supplier Relations

Just knowing your percentage isn't enough—the real magic happens when you use that data to make smarter decisions. This is where you can shift your kitchen from being a cost center to a true profit driver.

One of the most powerful tools in your arsenal is menu engineering. This is the art and science of analyzing the profitability and popularity of every dish you offer. By strategically designing your menu to highlight high-profit, high-popularity items, you can subtly guide customers toward the choices that make you the most money.

At the same time, you need to cultivate strong relationships with your suppliers. Don't be afraid to negotiate prices or shop around for better deals. Having partnerships with a few different suppliers can create some healthy competition and ensures you’re always getting the best possible price for quality ingredients.

Tackling Rising Food Costs and Waste

Let's be honest: managing inventory has never been more challenging. A huge part of this is the relentless rise in food prices, fueled by inflation and stubborn supply chain disruptions. In a recent survey, a staggering 91% of restaurant leaders reported their food costs went up, with 90% expecting that trend to continue. When outside pressures are this high, your internal controls become even more vital.

This is why precise inventory control is so important. To truly get a handle on food and beverage costs, you need to track every last item. Investing in effective inventory management systems is one of the best ways to monitor usage, reduce spoilage, and stop profits from disappearing from your shelves.

Waste reduction is another area with massive potential for savings. Every piece of food that hits the trash can is a direct blow to your bottom line. Thankfully, putting some simple programs in place can make a world of difference.

- First-In, First-Out (FIFO): This has to be a religion in your kitchen. Train your staff to always use the oldest inventory first. This means proper organization and clear labeling in your walk-ins and pantries are absolutely essential.

- Portion Control: Consistency is key. Use standardized scoops, scales, and ladles to ensure every dish that leaves the kitchen is the same. This not only keeps costs in check but also gives your customers a reliable experience every time.

- Get Creative with Scraps: Find ways to use trim and leftovers. Vegetable scraps can be transformed into a flavorful stock, and day-old bread makes fantastic croutons or bread pudding. For more ideas, check out our in-depth guide on reducing food waste in restaurants.

To give you a clearer picture, here are some of the most effective strategies you can start implementing today.

Actionable Strategies for Food Cost Control

This table summarizes some practical steps you can take to get a better handle on your food and beverage costs.

| Strategy Area | Actionable Tip | Expected Impact |

|---|---|---|

| Inventory Management | Conduct weekly inventory counts instead of monthly. | Faster identification of waste, theft, or spoilage issues. |

| Menu Engineering | Identify and promote your top 2-3 most profitable menu items. | Increased sales of high-margin dishes, boosting overall profit. |

| Supplier Relations | Get quotes from at least two secondary suppliers for your top 10 ingredients. | Leverage competition to negotiate better pricing or terms. |

| Portion Control | Implement mandatory use of portion scales and scoops for all line cooks. | Drastically reduces over-portioning and ensures menu consistency. |

| Waste Reduction | Start a "waste sheet" in the kitchen to track all discarded food items. | Pinpoints problem areas (e.g., a specific dish being sent back often). |

| Staff Training | Train staff on the cost of key ingredients (e.g., "that's $2 of cheese"). | Fosters a culture of cost-consciousness and care among the team. |

By focusing on these areas, you can turn a reactive approach to food costs into a proactive strategy.

By actively managing your COGS through sharp calculations, strategic menu design, and a relentless focus on waste reduction, you can transform your restaurant's biggest variable expense into a powerful tool for financial success.

Controlling the Rising Cost of Labor

If food costs are the engine of your restaurant, your people are the ones in the driver's seat. Your staff is the beating heart of the business, but they're also the second major piece of your prime costs. Getting this right is a delicate dance. Cut back too hard on hours, and you'll see service quality nosedive. The real goal is to optimize your team for peak performance, turning a major expense into your greatest asset.

It all starts with knowing your numbers. Just like with your food costs, you need a baseline to see how you're doing. For labor, that magic number is your labor cost percentage.

Calculating Your Labor Cost Percentage

Your total labor cost isn't just what you pay in hourly wages. It’s the full picture: salaries, overtime, payroll taxes, health insurance, and any other benefits or bonuses you offer. To get your labor cost percentage, you just need to see how that total stacks up against your sales.

Labor Cost Percentage = (Total Labor Cost / Total Sales) x 100

For most full-service spots, you want to see this number land somewhere between 25% and 35% of revenue. If you find yourself creeping above that range, it's a huge red flag that something needs to change. Nailing this metric is a cornerstone of smart restaurant operation management.

Building Smarter, Data-Driven Schedules

Once you know your percentage, you can stop scheduling based on gut feelings and start making decisions based on cold, hard data. The idea is to perfectly match your staffing levels to your customer flow. Modern Point of Sale (POS) systems are your best friend here. They can spit out reports showing you exactly when you're slammed and when it's a ghost town, right down to the hour.

Use that data to build your schedule. Maybe you need all hands on deck for that Friday night dinner rush, but you can run a much leaner crew for a slow Tuesday lunch. This way, you’re never caught short-staffed, but you’re also not paying people to lean against a wall.

The True Cost of a Negative Work Culture

A huge part of controlling labor costs is plugging one of the industry's biggest money drains: employee turnover. Every time someone walks out the door, it costs a small fortune to find, hire, and train their replacement—we're talking thousands of dollars. And it's not just the money. You lose their experience, their speed, and the rapport they've built with your regulars.

The best defense? A positive work culture where people actually want to stick around. This isn't about fluff; it's about smart business.

- Provide Growth Opportunities: Give your team a reason to stay by showing them a path forward. Invest in training and promote from within.

- Recognize Hard Work: A simple "great job tonight" can go a long way. People who feel appreciated work harder and stay longer.

- Offer Competitive Pay and Benefits: You don't have to be the highest-paying restaurant in town, but you do need to be fair for your market.

Investing in Training as a Profit Driver

It might sound backward, but sometimes you have to spend money to save money. Investing in great training is one of those times. A well-trained team is a more profitable team. They make fewer mistakes, which means less wasted food and fewer comped meals. They work more efficiently, which means they can handle a rush without getting frazzled.

Think about it: a server who really knows the menu is going to upsell more appetizers and desserts, directly boosting your bottom line. A line cook who has been trained properly works faster and more consistently, getting food out to happy customers. That investment pays for itself again and again.

The pressure is on. With things like minimum wage hikes, a staggering 85% of restaurateurs saw their payroll costs go up in 2024, and many expect to keep raising wages to attract and keep good people. This makes getting the absolute most out of the team you already have more critical than ever before.

Navigating Overhead and Occupancy Expenses

Once you've wrapped your head around food and labor costs, it’s time to look at the silent partners in your business: overhead and occupancy expenses. These are the fixed, predictable bills that keep the lights on and the doors open, no matter how many customers walk in. While they don't have the daily drama of food costs or payroll, getting them right is a non-negotiable part of any solid restaurant operating costs breakdown.

Think of these costs as your restaurant's foundation. It’s not the flashy part of the building, but if that foundation isn't solid and cost-effective, everything you build on top of it is at risk. This entire category should ideally fall between 5% to 10% of your total revenue, and here’s the best part: every single dollar you save goes straight to your bottom line.

Decoding Your Occupancy Costs

Let's start with the big one. Your single largest overhead expense will almost always be what it costs to occupy your space. This isn't just the monthly rent or mortgage check; it's a whole bundle of costs tied to your physical location. You have to understand every single line item before you even think about signing a lease.

A commercial lease is a different beast entirely from a residential one. You need to be on the lookout for hidden fees, especially the notorious Common Area Maintenance (CAM) charges. These are costs landlords pass on to tenants for taking care of shared spaces like parking lots, lobbies, and landscaping. They can add a hefty—and often unpredictable—sum to your monthly bill.

When you're at the negotiating table, get crystal clear on what's included. Are property taxes and building insurance baked into your base rent, or are those billed separately? A simple misunderstanding here can balloon into thousands of dollars in unexpected costs over the life of your lease.

Occupancy costs are where due diligence truly pays off. Scrutinizing your lease and negotiating hard on terms like CAM charges, renewal options, and tenant improvement allowances can save you a small fortune before you even serve your first customer.

Finding Savings in Your Utility Bills

Next up: utilities. The electricity, gas, water, and internet that make everything go. These costs can feel like they're set in stone, but you'd be surprised how much room there is for savings. A few smart changes to your habits and equipment can lead to some seriously satisfying reductions in your monthly spend.

No surprise here, the kitchen is the biggest energy hog in any restaurant. Your ovens, fryers, and refrigerators are running almost constantly, guzzling an incredible amount of power. Making smart investments in this area will pay you back over and over again.

- Energy-Efficient Appliances: When buying new or used equipment, always look for the ENERGY STAR label. The upfront cost might be a bit higher, but their lower energy use can literally save you hundreds or even thousands of dollars each year on your utility bills.

- Smart Conservation Practices: Get your team on board with simple energy-saving habits. This means turning off lights and equipment when they’re not needed, regularly cleaning refrigerator coils so they run efficiently, and fixing leaky faucets the moment they start dripping.

- Conduct an Energy Audit: Many utility companies offer free or cheap energy audits. An expert will come to your restaurant and pinpoint exactly where you’re wasting energy and money, giving you a clear roadmap for improvement.

Tracking the "Invisible" Administrative Costs

Finally, we have a category of smaller, often-ignored expenses that can nickel-and-dime you to death if you don't watch them. These are the administrative costs that keep the business side of your restaurant humming along. They might seem small individually, but together, they can take a real bite out of your profits.

Just think about all the recurring subscriptions and fees you pay every month. Your Point of Sale (POS) system, accounting software, payroll services, music licensing, and even bank fees. It's so easy to set these up on auto-pay and forget them, but they all deserve a regular check-up.

Make a master list of all your administrative overhead. It should look something like this:

- Software Subscriptions: POS, scheduling, inventory, accounting.

- Professional Services: Bookkeeper, lawyer, consultants.

- Licenses and Permits: Business license, liquor license, health permits.

- Maintenance Contracts: Pest control, hood cleaning, fire suppression systems.

- Bank and Credit Card Fees: Monthly account fees, payment processing fees.

When you create a budget with zero blind spots, you give yourself the power to find savings in places you never even thought to look. This detailed approach turns a scary list of expenses into a series of opportunities to be smarter with your money.

Investing in Growth: Marketing and Technology

In the restaurant business, some costs aren't just about keeping the lights on—they're about building a brighter future. Marketing and technology are perfect examples. When you start seeing them as smart investments instead of just expenses, you unlock the key to real, sustainable growth.

These aren't just numbers on a spreadsheet. They're the tools that pull customers through the door and create slick, efficient operations that save you money down the line. A well-timed social media campaign or a modern Point of Sale (POS) system can pay for itself many times over.

Budgeting for a Stronger Brand

Marketing is how you tell your story. A good rule of thumb is to set aside 3% to 6% of your revenue for marketing, but the real focus shouldn't be on the spending—it should be on the return. Every dollar has to work for you.

You don't need a blockbuster budget to make a real splash. The trick is to focus on smart, targeted efforts that hit the right people on the right channels.

- Local SEO: This one’s a must. When someone nearby searches for "best tacos near me," you need to be at the top of that list. It's one of the most powerful ways to grab new customers who are ready to buy.

- Social Media Engagement: Platforms like Instagram and Facebook are visual gold for restaurants. Use them to show off your incredible dishes, your team, and the atmosphere that makes your place special. It’s all about building a community.

- Email Marketing: An email list is a direct line to your biggest fans. You can send out specials, announce events, and keep them coming back for more. It's a simple, effective tool for driving repeat business.

Using Technology for Peak Efficiency

Here's a secret that the best operators know: modern restaurant tech is your weapon for taming your biggest operating costs. A solid technology setup doesn't just add to your bills; it actively trims your prime costs—food and labor—by automating tedious tasks and giving you the data you need to run a tighter ship.

Think of it like hiring the most efficient employee imaginable. This "employee" works around the clock, never messes up a calculation, and gives your team the insights they need to shine. That's how technology directly boosts your bottom line.

A modern POS system is the brain of your entire operation. It's so much more than a cash register. It's a goldmine of data on what’s selling, who’s selling it, and what you have in stock, letting you make sharp, informed decisions that cut costs and drive profit.

Analyzing Your Restaurant Technology ROI

Choosing the right tech is all about knowing what problem you're trying to solve and how it will pay you back. You want to invest in tools that create real, measurable savings in other parts of your business.

Before you invest, it's worth mapping out how each tool can help you save money or make more of it.

Table: Analyzing Your Restaurant Technology ROI

| Technology Type | Primary Function | Potential ROI Area |

|---|---|---|

| POS System | Processes sales and tracks data | Reduces order errors, provides sales data for menu engineering, and tracks labor hours accurately. |

| Inventory Management Software | Tracks ingredient usage and stock levels | Drastically cuts food waste, prevents over-ordering, and helps identify potential theft. |

| Online Ordering Platform | Allows customers to place orders directly | Increases order volume, improves order accuracy, and can free up staff from answering phones. |

| Employee Scheduling Software | Creates and manages staff schedules | Optimizes staffing levels to prevent over-staffing, reduces time spent on scheduling, and controls overtime. |

Looking at this, it becomes clear that the initial cost is only part of the story. The real value is in how these tools help you run a smarter, more profitable restaurant every single day.

By putting your money into marketing that builds your brand and technology that sharpens your operations, you turn simple expenses into powerful drivers of growth. This forward-thinking approach is what separates the restaurants that just survive from the ones that truly thrive.

Building a Profitable Financial Strategy

Knowing your operating costs is half the battle. The other, more important half? Turning that knowledge into a smart, forward-thinking financial strategy. This isn't a one-and-done task; it's the ongoing work that separates the restaurants that thrive from those that just scrape by.

It’s about shifting from reactive problem-solving—like scrambling when a bad month reveals your food costs are out of control—to proactive financial planning. When you have a system to monitor your numbers regularly, you're the one in the driver's seat.

Creating a Financial Health Checklist

To stay ahead of the curve, you need a routine for financial check-ins. Think of it as a pilot's pre-flight checklist; it’s a simple way to make sure all your critical systems are running smoothly before a small issue becomes a big problem. A quick weekly and monthly review can make all the difference.

Here’s a practical checklist you can start using today:

-

Weekly Review:

- Prime Cost Check: Do a quick calculation of your prime cost (food + labor) as a percentage of your weekly sales. Is it holding steady within your target of 55-65%?

- Sales vs. Labor: Pull up your daily sales reports and compare them to your labor schedule. Were there any days where you were obviously over or understaffed?

- Waste Sheets: Take a hard look at what your team is throwing away. Are you seeing the same ingredient or dish pop up over and over again?

-

Monthly Review:

- Full P&L Analysis: This is your deep dive. Pull up your Profit and Loss (P&L) statement and compare it to previous months and the same time last year. Getting comfortable with a sample profit and loss statement for a restaurant is a non-negotiable skill for any operator.

- Break-Even Point: Recalculate what it takes to break even. Have your fixed costs crept up? If so, you'll need more revenue just to get back to zero.

- Budget vs. Actuals: How did your actual spending line up against your budget? Pinpoint any big differences and figure out exactly what happened.

Setting and Achieving Financial Goals

Once you have this data, you can set real, meaningful goals. A good goal isn't just "make more money." It's specific and measurable. For example: "I will reduce my food cost percentage by 2% over the next quarter by renegotiating with my top three suppliers."

Consistently tracking your key numbers and setting clear targets turns financial management from a chore into your most powerful tool for growth. You gain real control over your restaurant's future, backed by the confidence that comes from knowing your business inside and out.

Frequently Asked Questions

Getting a handle on the numbers is one of the biggest challenges of running a restaurant. Let’s tackle some of the most common questions operators have when breaking down their operating costs.

What Should My Cost Percentages Look Like?

There’s no single "right" answer here, as the ideal numbers really depend on your specific concept. But we can look at some solid industry benchmarks to get our bearings.

-

Quick-Service Restaurants (QSR): Think fast food or fast-casual. Labor costs tend to be lower, hovering around 25-30%, while food costs might be a bit higher to account for all that packaging. The goal is a lean, efficient prime cost.

-

Full-Service Casual Dining: For a sit-down spot, you're usually aiming for a prime cost between 60-65%. Labor is a bigger piece of the pie (often 30-35%) to cover servers and hosts, with food costs typically managed in the 28-32% range.

-

Fine Dining: At the high end, labor costs can easily climb past 35%. That's the price for highly skilled chefs and a top-tier service team. Food costs also run higher to reflect the premium ingredients your guests expect.

Treat these as guideposts, not gospel. The most critical task is to know your numbers inside and out and manage them actively.

What Is the Most Common Hidden Cost?

If there’s one expense that blindsides new and even veteran owners, it's equipment repairs and maintenance. It's easy to budget for the big purchase of a new walk-in cooler, but what about when it breaks down during a Saturday night rush? That’s not just a headache; it's a cash flow crisis.

Most operators forget to account for the constant wear and tear on their kitchen workhorses.

A proactive maintenance plan for your essential kitchen equipment is not a cost—it's an insurance policy. Regularly servicing your appliances prevents expensive emergency repairs, reduces energy consumption, and extends the life of your most critical assets.

Ignoring regular upkeep is like gambling with your business. Sooner or later, you'll face an unexpected, five-figure repair bill that could have been avoided. To discover exclusive deals on reliable restaurant equipment and supplies, it's wise to stay informed about industry trends.

What Technology Offers the Biggest Impact?

Hands down, a modern Point of Sale (POS) system. A good POS is so much more than a glorified cash register; it’s the brain of your entire restaurant.

Think about it: it's the one tool that connects your sales floor, your kitchen, and your back office. A powerful POS system gives you real-time data on sales trends, tracks every ingredient in your inventory, and helps you build labor schedules based on actual demand. This information lets you make smart, data-driven decisions that directly slash costs and boost profitability.

At Encore Seattle Restaurant Equipment, we help restaurant owners and chefs discover the latest news and exclusive deals on restaurant equipment and supplies. Stay informed about industry trends and find the perfect new and used equipment to keep your operating costs in check and your kitchen running smoothly. From energy-efficient refrigeration to reliable cooking stations, we provide the tools you need to build a more profitable restaurant. Discover our inventory at https://encoreseattle.com.