Your Guide to Mobile Food Vendor Insurance

Share

Think of mobile food vendor insurance less like a single policy and more like a custom-built shield for your business. It's a bundle of specific coverages designed to protect your food truck, cart, or trailer from the unique financial risks you face every single day.

This isn't just about ticking a box; it's about making sure one bad day—a kitchen fire, a customer injury, or a roadside accident—doesn't shut down the business you've worked so hard to build. By staying informed about industry trends, restaurant owners and chefs can better understand the protections they need.

Why Your Food Truck Needs Insurance to Survive

Running a food truck without the right insurance is like having a commercial kitchen with no fire suppression system. You hope you’ll never have to use it, but operating without one is an unbelievable gamble. For a mobile food vendor, proper coverage isn't just a good idea—it's a non-negotiable ingredient for financial security and long-term success.

The risks you face are completely different from a brick-and-mortar restaurant. Your entire business is on wheels, which means you're exposed to dangers on the road and at every new location you park. A simple fender bender, a customer tripping over a generator cord, or a sudden equipment failure can trigger a cascade of expenses that could easily dwarf your annual insurance premium.

A Safety Net for the Unpredictable

Proper mobile food vendor insurance is the financial safety net that catches you when things go wrong. It's the critical line of defense standing between a minor mishap and a catastrophe that could close your service window for good.

Without it, you are personally on the hook for every single cost, including:

- Legal Fees: The astronomical cost of defending your business if a customer sues you for getting sick or injured.

- Medical Bills: Covering a customer's medical expenses if they slip and fall near your truck.

- Repair Costs: Paying out-of-pocket to fix your vehicle and expensive kitchen equipment after an accident.

- Replacement Costs: The daunting expense of buying all new restaurant equipment and supplies after a fire, theft, or major breakdown.

The hard truth is that a single significant claim can instantly wipe out your profits, drain your savings, and force you to shut down. Insurance works by transferring that massive financial risk from your shoulders to the provider, giving you the peace of mind to focus on what you do best: making great food.

The food truck industry is bigger than ever, and with that growth comes a greater need for solid protection. The market for this specialized insurance has grown right alongside the industry, and it's projected to hit around $407 million by 2025. As you build your business, it’s also smart to understand the different types of business loans available, as lenders will almost always require proof of insurance before approving funding.

The Core Policies Every Food Vendor Must Have

Building a solid insurance plan for your food truck is a lot like perfecting a signature recipe. You start with a few essential, high-quality ingredients that you absolutely cannot skip. These policies are the foundation of your business's safety net, protecting you from the kind of common, everyday risks that can shut a vendor down for good.

Think of these as the non-negotiables. Each one covers a different, vital part of your operation, and together they create a powerful shield that lets you focus on the food, not the financials of a potential disaster. Let's break down exactly what you need.

General Liability Insurance

First up is General Liability Insurance. This is your absolute frontline defense. It's designed to protect you when your business is accused of causing injury or property damage to someone else—basically, anyone who isn't on your payroll. It’s the policy that kicks in if a customer scalds their hand on a hot drink, slips on a patch of spilled water by your truck, or trips over a poorly placed power cable.

And believe me, these things happen. A 2023 report tracked 53 insurance claims from food truck owners, and general liability issues were the most common culprit. One claim ended up costing $6,598 after a customer simply slipped on a wet surface near the truck. It’s a stark reminder of how quickly a normal day can turn into a major expense.

Commercial Auto Insurance

Since your kitchen is on wheels, your personal car insurance won't cut it. Not even close. You need Commercial Auto Insurance, which is built specifically for vehicles used in a business. This policy covers your truck or trailer whether you're driving to a festival, parked and serving customers, or just running out for supplies.

Picture a simple fender-bender on your way to a sold-out event. The accident not only dings up your truck but also destroys that expensive custom vinyl wrap you just had installed. A commercial auto policy is what helps pay for those repairs, not to mention the liability costs if you’re at fault for injuring someone or damaging their car.

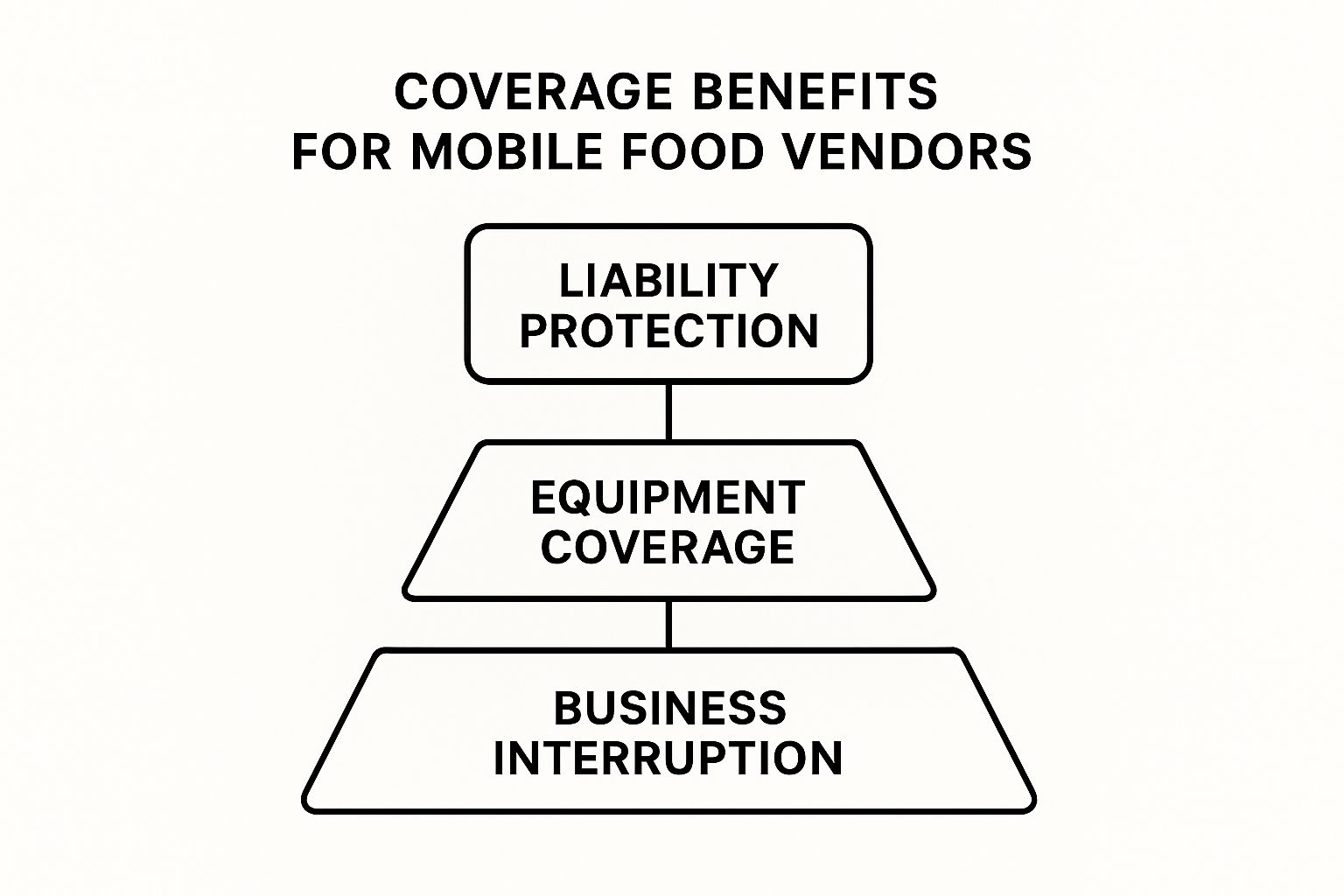

As you can see, liability is that first crucial layer, followed by protection for your physical assets and the ability to keep your business running.

Equipment Insurance

Finally, let's talk about the heart of your business: all that expensive kitchen equipment. This is where Equipment Insurance comes in. It's often referred to by a more technical name like Inland Marine Insurance or Business Personal Property Coverage, but the job is the same: to protect your valuable gear from theft or damage. We’re talking about everything from your deep fryer and griddle to your POS system and refrigerators.

Imagine a power surge at an outdoor market fries your refrigeration unit. Suddenly, you're out thousands of dollars in spoiled inventory and facing a hefty repair bill. This is exactly what equipment insurance is for—it helps cover the cost to fix or replace your gear so you can get back to serving customers as quickly as possible. To learn more about outfitting your mobile kitchen, check out this guide on kitchen equipment for your food truck.

Specialized Coverage for Unique Food Truck Risks

Your basic auto and general liability policies are a great start, but running a food truck isn't a basic business. You're dealing with risks that go way beyond a simple fender bender or a slip-and-fall. This is where specialized insurance comes in. Think of these policies less as add-ons and more as essential gear for protecting your unique mobile operation from some very specific, and potentially very expensive, problems.

Your reputation is built on the delicious food you serve, but that very food can also be your biggest liability. If someone claims your tacos made them sick, you need to be ready.

Product Liability for Foodborne Illness

This is an absolute must-have for any mobile food vendor insurance package. Product Liability Insurance is designed specifically to cover claims that come directly from the food you sell. If a customer gets sick from a foodborne illness, has an unexpected allergic reaction, or finds something in their meal, this policy is your financial backstop. It’s built to handle their medical bills and your legal defense fees.

The global market for this type of insurance was recently valued at around $3.6 billion and is expected to climb to nearly $6 billion by 2033. That explosive growth shows just how seriously the food industry takes these risks. You can find more data on the food and beverage liability market over at Verified Market Research.

Workers' Compensation for Your Team

Planning on hiring help? Even if it's just one part-time cashier or a prep cook for busy weekends, most states will legally require you to have Workers’ Compensation Insurance. This isn't optional; it's the law.

Workers' comp does two critical things for you:

- It takes care of medical bills and covers a portion of lost wages for any employee who gets hurt while working.

- It shields you, the owner, from being personally sued by that injured employee.

In a fast-paced food truck, injuries like burns from a fryer, deep cuts from prep work, or back strains from lifting heavy stock are all too common. This coverage makes sure your crew is looked after without sinking your business.

Inland Marine Insurance for Gear in Motion

Your equipment insurance is great for when everything is parked safely. But what about when you’re driving to a festival or set up at a catering gig? That's where Inland Marine Insurance steps in. People in the industry often call it an "equipment floater" because it protects your valuable gear while it's on the move.

This policy covers your essential equipment—generators, POS systems, refrigerators, grills—when it is:

- In transit between your commissary kitchen and a service location.

- Temporarily stored somewhere that isn't your home base.

- Being used at a fair, market, or private event.

Think of it as insurance for all the vital equipment that isn't physically bolted to your truck. It ensures your assets are protected wherever your business takes you, which is a key piece of any solid business strategy. If you need help with that, check out our guide on how to create a food truck business plan.

Understanding the Cost of Food Vendor Insurance

So, let's get down to the question on every food truck owner's mind: "How much is this actually going to cost me?" There's no simple, flat-rate answer for mobile food vendor insurance. Think of it like pricing a catering gig—the final cost depends entirely on the specifics of the job.

Your insurance premium is tailored to your unique business. Insurers look at your operation to figure out the level of risk you present. A vendor selling pre-packaged popsicles from a small pushcart is a much different risk profile than a full-on BBQ rig with smokers and deep fryers, and their premiums will reflect that.

Key Factors Driving Your Premium

Imagine your insurance premium on a seesaw. On one side, you have your business operations; on the other, you have the cost. The more risk you add to your side, the higher the price on the other side needs to be to keep things balanced.

Insurers zoom in on a few key areas to calculate your rate:

- Vehicle Value and Type: This one's straightforward. A gleaming, custom-built truck valued at $150,000 has a much higher replacement cost than a $20,000 converted trailer. The more valuable the vehicle, the more it costs to insure.

- Cooking Equipment: What's going on in your kitchen? A simple setup with a panini press and a microwave is pretty low-risk. But once you introduce open-flame charbroilers or deep fryers, the potential for a fire claim shoots up, and your premium will follow. Staying on top of your commercial kitchen equipment maintenance can sometimes show insurers you're a responsible operator.

- Operating Radius: Where you roam makes a big difference. A truck that stays within a quiet suburban county faces fewer road hazards than one crisscrossing state lines for huge festivals. More miles and more varied legal jurisdictions equal more risk.

- Claims History: Just like with your personal car insurance, a clean track record pays off. If you’ve never filed a claim, you'll get a better rate. A history of accidents, however, signals a higher risk to insurers.

To see how these factors play out, let's look at a couple of different scenarios.

Factors Influencing Your Insurance Premium

| Cost Factor | Low Premium Example | High Premium Example |

|---|---|---|

| Vehicle | A simple, used $15,000 trailer. | A brand-new, fully customized $120,000 truck. |

| Menu/Equipment | Pre-packaged goods, coffee, sandwiches. | Deep fryers, open-flame grills, full smoker. |

| Operations | Operates only at a local farmer's market. | Travels to large, multi-state music festivals. |

| Claims History | Five years in business with zero claims filed. | Two at-fault auto accidents in the past three years. |

As you can see, two food vendors can have wildly different insurance costs based entirely on their operational choices.

Budgeting for Your Insurance Costs

While every quote is custom, you need a number for your business plan. Most food truck owners should budget somewhere between $1,500 and $4,000 a year for a solid policy that includes general liability and commercial auto coverage. That breaks down to about $125 to $330 per month.

Remember, this is just a ballpark figure. If you need higher coverage limits, add-on policies like liquor liability, or if your business model is inherently high-risk, you'll likely land on the higher end of that range, or even exceed it.

The coverage limits you choose are a major driver of cost, too. A policy with a $1 million liability limit will obviously cost more than one with a $500,000 limit. But that extra cost buys you significantly more protection when you need it most. Insurance isn't just an expense to be minimized; it's a critical investment in your business's stability.

How to Find the Right Insurance Provider

Choosing an insurance provider can feel like you're trying to navigate a maze without a map. But if you follow a clear process, you can find a partner who really understands the ins and outs of your mobile business. Remember, the goal isn't just to check a box and buy a policy; it's to find an expert who can protect the business you've poured everything into.

Your first move? Get organized. Before you even think about making calls, pull together all the essential information an insurer will need to give you an accurate quote.

A little bit of prep work here will save you hours of back-and-forth later. It also ensures the quotes you get are based on your actual business, not just a bunch of guesswork.

Prepare Your Business Snapshot

Before you start asking for quotes on mobile food vendor insurance, you need to build a complete file on your operation. Think of it as creating a resume for your business that you can hand over to potential insurers.

Your document checklist should include things like:

- Vehicle Information: Have your truck or trailer’s Vehicle Identification Number (VIN) handy, along with its current value and a list of any custom modifications you’ve made.

- Equipment Inventory: Create a detailed list of all your major restaurant equipment and supplies. Be sure to include the make, model, and what it would cost to replace each piece.

- Business Operations: Outline your menu, your projected annual revenue, and make a list of the specific cities or counties where you plan to operate.

- Employee Details: Note the number of employees you currently have (or plan to hire soon) and what you estimate your annual payroll will be.

Once you have this information ready, you can start the search. The real key here is to look for providers who actually specialize in the food and beverage industry. A generalist agent might not understand why a deep fryer is a bigger risk than a coffee machine, but a specialist will get it immediately.

A smart strategy is to get quotes from at least three different providers. This forces you to compare not just the prices, but also the fine print of what each policy covers—and more importantly, what it excludes.

Critical Questions for Your Insurance Agent

After you have a few quotes in hand, it's time to start digging deeper. A low price looks great on paper, but it’s worthless if the policy has huge gaps that leave your business exposed.

Use these questions to really vet each provider and understand what you're actually buying:

- Does this policy cover my loss of income if my truck is out of commission for repairs after an accident? This is what helps you survive an extended shutdown.

- What specific exclusions should I be worried about? You need to ask directly about limitations on things like equipment breakdown, food spoilage, or off-site catering events.

- How do you handle claims for food trucks, specifically? You’re looking for a provider who has a proven track record of handling claims for mobile businesses quickly and efficiently.

- How easily can I add an 'additional insured' for a one-day event? Festivals and farmers' markets require this all the time, so the process needs to be fast and simple.

Asking these kinds of tough questions helps you look past the price tag and find a real insurance partner. A good agent should be able to explain your coverage in plain English and help you build a policy that truly protects your mobile food dream.

Common (and Costly) Insurance Traps and How to Sidestep Them

When it comes to mobile food vendor insurance, you can learn a lot from the stumbles of others—and it's a whole lot cheaper than learning those lessons firsthand. A few surprisingly common slip-ups can put your entire business on the line. Getting the right policy is only half the battle; knowing how to manage it is just as crucial.

Mistake #1: Relying on Your Personal Auto Policy

This is probably the single most frequent blunder we see. It’s easy to assume your personal car insurance will cover your food truck, but that’s a dangerous gamble. Personal policies are designed for personal use, period.

If you get into an accident while driving to a gig or even just picking up supplies, your insurer will almost certainly deny the claim once they realize the vehicle is for business. That leaves you on the hook for every last dollar of the damages.

Mistake #2: Forgetting to Add an "Additional Insured"

Ever been turned away at the gate of a big festival? This could be why. Most event organizers, property owners, and festival coordinators will require you to add them as an "additional insured" on your general liability policy.

It’s a standard request, but forgetting this simple step means you’ve breached your contract. You won't be allowed to set up, and you’ll lose out on all that potential revenue. It's a quick fix that can save a whole weekend.

Mistake #3: Not Updating Your Policy After Upgrades

Imagine you finally invest in that high-end generator and a new, top-of-the-line refrigeration unit. Your truck is now a lean, mean, food-slinging machine. But you never told your insurance agent.

If a kitchen fire destroys that new equipment, your policy will only pay out the value of the old gear you had listed. You’re left with a massive financial hole and the gut-wrenching task of buying that expensive equipment all over again.

Think of your insurance policy as a living document. It needs to grow and change right along with your business. Any time you make a significant change—upgrading restaurant equipment and supplies, hiring an employee, or expanding where you operate—your first call should be to your agent.

Mistake #4: Underinsuring Your Kitchen Gear

It’s the classic rookie mistake. New owners get so focused on insuring the truck itself that they completely undervalue all the specialized, expensive equipment packed inside.

They might insure their gear for $20,000 thinking that’s enough, but the actual cost to replace everything—the fryer, the griddle, the prep stations—is closer to $40,000. If disaster strikes, that gap comes straight out of your pocket.

Here’s how to stay out of trouble:

- Insist on a commercial auto policy. Never, ever try to skate by with personal coverage.

- Read every event contract. As soon as you book a gig, check the insurance requirements and add the "additional insured" right away.

- Update your coverage with every big purchase. New smoker? Call your agent. New espresso machine? Call your agent.

- Do a yearly equipment inventory. Add up what it would actually cost to replace every single piece of gear at today's prices, and make sure your coverage limit matches that number.

Common Questions Food Truck Owners Ask

Getting into the nitty-gritty of mobile food vendor insurance always brings up a few common "what if" scenarios. Let's tackle some of the questions I hear most often from operators just like you.

What if I Only Run My Truck in the Summer? Do I Still Need Year-Round Insurance?

Yes, you almost certainly do. Think of it from the perspective of an event organizer or the city permit office. They want to see that you're a legitimate, protected business before they even consider giving you a spot, and that means having continuous coverage.

Liability doesn't just disappear when you park the truck for the winter. A foodborne illness claim could pop up months after the fact, or an accident could happen on your very first day back in the spring. It's best to work with an agent to find a policy that makes sense for a seasonal operation, but dropping coverage entirely is rarely an option.

Event Organizers Keep Asking for an "Additional Insured Endorsement." What Is That?

This is a standard request, so it's good to get familiar with it. An "additional insured" is simply another person or organization—like the company running a music festival or the owner of the private lot you're parking on—that you temporarily add to your general liability policy for a specific event.

By adding them, you're extending your insurance protection to cover them if a lawsuit arises because of something your business did at their venue. For example, if a customer trips over your power cord and sues both you and the festival, this endorsement ensures your policy steps in to defend them too. It’s a non-negotiable part of booking almost any gig.

Can't I Just Use My Personal Auto Insurance for the Truck?

Absolutely not. This is one of the most critical distinctions to understand. Your personal auto policy is written exclusively for your private, non-commercial car. The moment you use a vehicle for business—especially a heavily modified one packed with thousands of dollars of cooking equipment—that personal policy becomes void.

If you get into an accident while driving to an event, your personal insurer will deny the claim flat out. You need a dedicated commercial auto policy. This type of insurance is designed to cover the higher risks, the vehicle's specialized equipment, and the reality that it's a place of business on wheels.

At Encore Seattle Restaurant Equipment, we get what it takes to power a successful mobile kitchen. Whether you're building a new truck from scratch or upgrading your current setup, we've got the gear you need—from high-performance cooking stations to space-saving refrigeration. To discover the latest news and exclusive deals on restaurant equipment and supplies, check out our huge selection of new and used equipment at prices that work for your budget by visiting us at https://encoreseattle.com.