The Real Costs to Open a Bar Uncovered

Share

So, you've decided to open a bar. Fantastic. Now let's talk about the money, because this dream comes with a serious price tag. For restaurant owners and chefs venturing into the bar scene, understanding these finances is the first step toward success. The honest truth is that opening a bar is a major financial commitment, and the final number on the check can swing wildly.

You could be looking at anywhere from $110,000 to over $850,000 to get the doors open. A small, cozy pub in a leased space will land on the lower end, while a high-end cocktail lounge in a downtown hotspot will push you toward the higher figure. It all comes down to your vision, your location, and how big you want to go. This guide will help you stay informed about industry trends and the essential equipment and supplies you'll need.

A First Look at Bar Startup Costs

Think of your bar's budget like building a custom home. You can’t just pick one number out of a hat. The final cost is the sum of dozens of individual decisions, from the foundation (your rent and licenses) to the paint on the walls (your decor and glassware).

To get a real handle on this, you need to break it down into core expense categories. These are the financial pillars that will hold up your entire business. Getting these right from the start is non-negotiable. If you skimp on one, the whole structure could come crashing down later.

The Core Financial Pillars of a New Bar

Every single bar, whether it's a dive or a distillery, has to account for the same fundamental startup costs. We can group these into a few essential buckets that will form the backbone of your budget.

- One-Time Capital Investments: These are the big, gut-punch expenses you'll pay upfront. Think down payment on a property, massive renovations, and the holy grail of them all—your liquor license.

- Equipment and Supplies: This is all the gear that makes a bar a bar. We're talking everything from the beer tap system and ice machines to shakers, glassware, and the point-of-sale (POS) system that keeps the money flowing. Discovering exclusive deals on this equipment is key.

- Initial Inventory and Staffing: You can't open with empty shelves. This bucket covers stocking your bar with every bottle of booze, beer, and wine you plan to serve, plus the cost of hiring and training the crew who will sling the drinks.

- Working Capital: This is your safety net. It’s the cash you need on hand to cover payroll, rent, and utilities for the first few months while you’re building a customer base and before you start turning a profit.

The latest industry data backs all this up. Reports show that launching a bar in 2025 will likely cost between $110,000 and $850,000. The biggest factors are always the concept, the city you're in, and whether you buy or lease the space. Most new owners choose to lease, but buying the building will obviously send those initial costs skyrocketing.

The average startup cost tends to hover around $480,000, with some estimates putting it closer to $425,000. You can dig deeper into the numbers and see how others are budgeting by exploring industry resources, like the data on bar startup expenses from Restroworks.com.

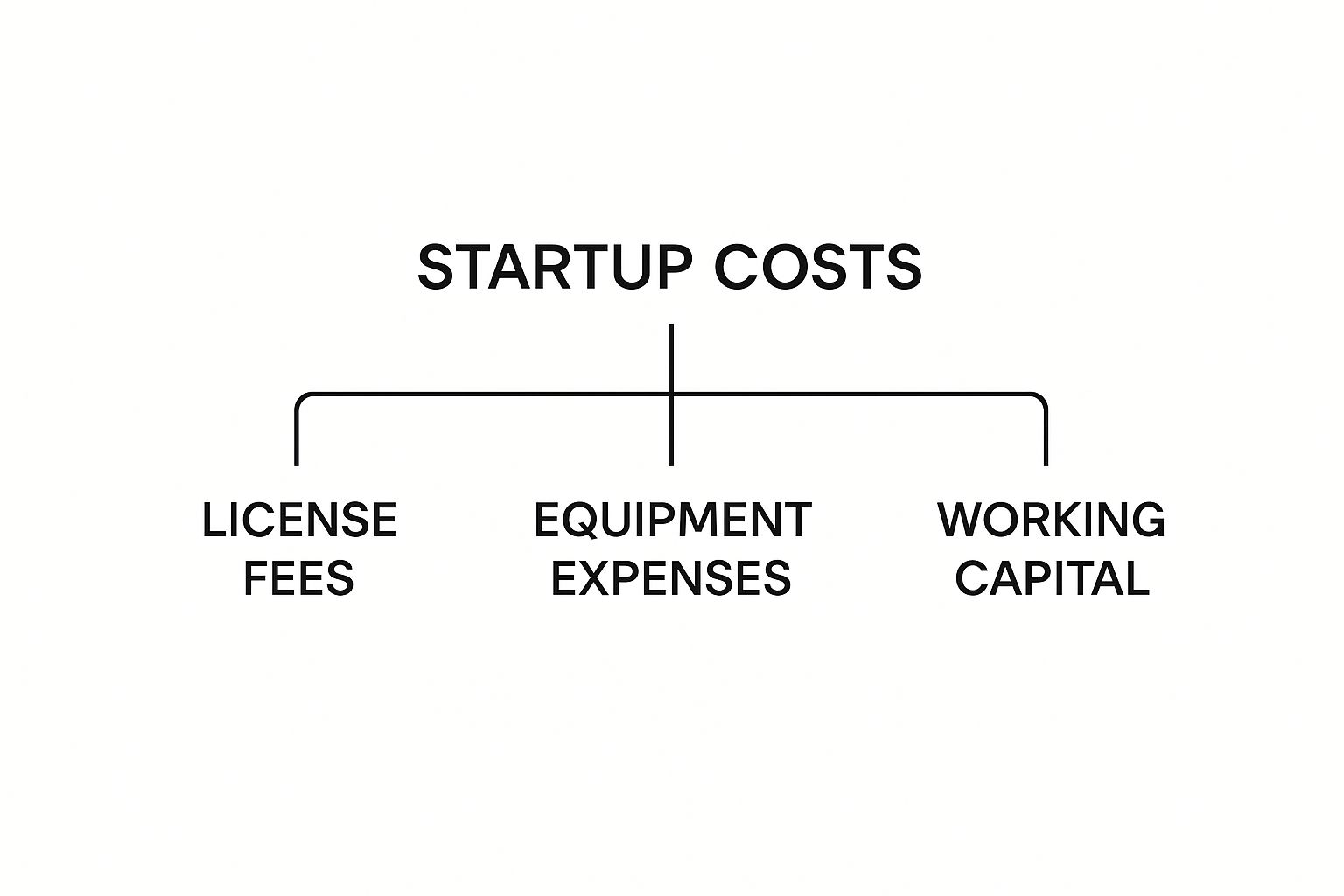

This chart gives you a clear visual of how your money gets split between the major cost centers: License Fees, Equipment Expenses, and Working Capital.

As you can see, it’s a balancing act. You need to sink money into the one-time costs to get set up, but you absolutely have to hold enough back for the working capital that will keep you afloat while you find your footing.

Calculating Your One-Time Capital Investments

Alright, let’s get down to brass tacks. We’ve talked high-level numbers, but now it’s time to break down the big, one-time investments that turn an empty shell into a real, functioning bar. These are the foundational costs to open a bar, and they represent the biggest chunk of cash you'll need right out of the gate.

Getting these figures right is the difference between a smooth launch and a full-blown budget crisis before you’ve even poured your first drink. Think of this phase as building your bar's skeleton—each bone, from the property down payment to the liquor license, has to be solid. This is where your dream starts to take shape, but it's also where costs can spiral if you're not paying close attention.

Securing and Building Out Your Space

Your first huge expense is the property itself. Whether you lease or buy, you're going to need a substantial amount of cash upfront. Leasing usually means a security deposit plus the first month's rent, which could run anywhere from $5,000 to $20,000 depending on your city. If you’re buying, you’re looking at a much larger down payment, typically 10% to 20% of the building's price.

Once you have the keys, the real work starts. The build-out or renovation phase can easily be the single most expensive line item in your entire startup budget. This covers everything from moving walls and re-doing the floors to all the plumbing and electrical work needed to support a commercial bar. A simple cosmetic refresh for a small neighborhood spot might run you $25,000, but a full gut renovation for an upscale cocktail lounge can soar past $250,000 without breaking a sweat.

When you're mapping out these initial costs, it's crucial to grasp just how much a commercial renovation can demand. To get a better handle on what's involved, this guide to tenant finish projects is a fantastic resource for preparing your budget.

I’ve seen it happen a hundred times: new owners massively underestimate renovation costs. Do yourself a favor and add a 15-20% contingency fund to your construction budget. It will save you when you inevitably find hidden structural issues or need to make last-minute updates to meet code.

The High Cost of Licensing and Professional Fees

Getting your liquor license is one of the most complex and expensive hurdles you'll face. The process and the price tag vary wildly by state, county, and even city. In some places, you might get a new license for a few thousand dollars. In others, you’re forced to buy one from an existing business on the open market, where prices can climb to $400,000 or more. It’s a huge variable.

And don't forget all the professionals you need to hire along the way. You'll have an architect designing the space, a lawyer reviewing your lease and navigating the licensing maze, and maybe even a business consultant. These fees can easily tack on another $10,000 to $30,000 to your one-time investments.

Furnishings and Foundational Equipment

Finally, you have to actually equip the space. I’m not talking about cocktail shakers and glassware yet—this is about the big-ticket items that define your bar's functionality and vibe.

- Bar Construction: The bar is the heart of your operation. A custom-built bar can run from $10,000 to $100,000, depending on the materials, size, and features like built-in sinks and speed rails.

- Draft Beer System: A professional draft system is non-negotiable for most bars. To stay informed on the latest systems and supplies, checking industry news and supplier updates is crucial.

- Furniture and Fixtures: This is all your tables, chairs, barstools, and lighting. You should budget at least $15,000 to $50,000 for quality commercial-grade pieces that can take a beating.

- Signage and Decor: Your sign out front and the decor inside are what create your brand’s first impression. This can be as simple as a $2,000 sign or as elaborate as $20,000+ for custom neon and a fully themed interior.

Equipping Your Bar for Long-Term Success

Alright, you've got the space built out. Now it’s time to fill it with the tools of the trade. The equipment you choose is the real engine of your bar—it's what will directly impact your team's speed, the quality of your drinks, and, ultimately, your bottom line. This part of the budget covers everything from the big, mission-critical machines down to the small wares your bartenders will have in their hands every single minute.

Think of it this way: your bar is the stage, but the equipment is your cast and crew. A busted ice machine or a clunky point-of-sale (POS) system can bring the entire performance grinding to a halt on a busy Friday night. For restaurant owners and chefs, finding exclusive deals on top-tier restaurant equipment and supplies can make a significant difference. Getting these costs right is a huge piece of the puzzle when figuring out the total costs to open a bar.

Big-Ticket Items Your Bar Cannot Live Without

First things first, let's talk about the heavy hitters. These are the major pieces of equipment that form the absolute backbone of your operation. They're non-negotiable investments, and the costs can stack up fast, typically landing somewhere between $30,000 and $120,000.

Here’s a rough breakdown of the essentials you'll be shopping for:

- Commercial Refrigeration: This isn't just one fridge. We're talking back-bar coolers, a walk-in for kegs and bulk inventory, and undercounter units. You should budget between $5,000 and $30,000 for this category alone.

- Ice Machine: Don't skimp here. A commercial ice machine is your best friend. A solid model that can keep up with demand will run you $2,000 to $7,000.

- POS System: A modern POS does so much more than take payments. It tracks inventory, manages orders, and spits out invaluable sales data. A full setup with terminals and printers costs anywhere from $1,500 to $10,000.

- Dishwasher and Glassware Station: For speed and proper sanitation, you need a high-temperature commercial glass washer. This will set you back $3,000 to $8,000.

These are serious purchases, but they're an investment in your bar's future. The global market for bars and cafes is projected to grow from $502.55 billion in 2025 to $627.19 billion by 2029, and that growth is fueled by customers seeking premium experiences. Reliable equipment is what allows you to deliver that experience consistently.

One of the most common—and costly—mistakes I see new owners make is buying cheap, residential-grade equipment to save a few bucks upfront. It’s a recipe for disaster. Commercial-grade gear is built to take a beating, and it will save you thousands in repairs and lost business down the road.

The Small Wares That Make a Big Difference

Beyond the big machines, you're going to need an army of smaller tools and supplies. While a single shaker or jigger isn't expensive, these items add up to a surprisingly significant cost, often totaling $5,000 to $15,000. Whatever you do, don't underestimate this category in your budget.

This is everything your bartenders need to actually craft perfect drinks, and do it efficiently.

Essential Bar Tools and Supplies:

- Shakers and Strainers

- Jiggers and Pour Spouts

- Bar Spoons and Muddlers

- Cutting Boards and Knives

- Glassware (a wide variety for beers, wines, and cocktails is a must)

- Bar Mats and Spill Trays

Trying to remember every little thing can feel overwhelming. Using a comprehensive checklist of commercial bar equipment is a great way to make sure you've accounted for every last item before you open your doors.

Smart Sourcing: New vs. Used Equipment

One of the biggest financial decisions you'll face is whether to buy your equipment new or used. Each route has some clear pros and cons that will impact both your initial cash outlay and your long-term expenses.

New Equipment:

- Pros: It comes with a manufacturer's warranty, it’s in perfect working order, and it often features the latest energy-saving tech.

- Cons: It carries the highest price tag and starts depreciating the second it leaves the showroom.

Used Equipment:

- Pros: The initial cost is significantly lower, which can help you stretch your budget.

- Cons: It usually lacks a warranty, might have a shorter lifespan, and could saddle you with unexpected repair bills.

Often, the smartest play is a hybrid approach. It makes a lot of sense to buy sturdy items like stainless steel prep tables and sinks used. But for things like refrigeration and ice machines where reliability is everything, it's almost always worth it to invest in new. Finding a trusted restaurant supplier can be a game-changer, giving you access to good deals on both new and certified refurbished gear to help you spend wisely without sacrificing quality.

Mastering Your Monthly Operating Expenses

Once you finally open your doors, the money game completely changes. You’re no longer focused on those big, one-time startup checks you had to write. Now, it's all about the relentless rhythm of your monthly operating expenses. These are the costs that truly determine if you’ll sink or swim, making them a crucial piece of the puzzle when calculating the total costs to open a bar.

Think of it this way: your startup costs are what you spent to build the boat. Your operating expenses are the fuel, crew, and supplies you need to keep it sailing, month after month. Staying informed about industry trends and pricing for supplies will be vital. If you don't have a firm grip on these numbers, even the most impressive-looking bar will find itself dead in the water pretty quickly.

The Core Recurring Costs

Every month, a predictable stack of bills will land on your desk. These are your fixed and variable costs, and they’re the foundation of your entire monthly budget. Fixed costs, like your rent, don’t change whether you're packed or empty. Variable costs, like your liquor orders, go up and down with your sales.

Initial investments and operating expenses heavily influence the financial path of a new bar. While startup costs can swing wildly from $50,000 to over $710,000, it’s the ongoing monthly bills that really put your business model to the test. These can easily average around $24,200, chewing up a staggering 88% of your revenue in the early days and pushing back your break-even point. To get a deeper dive on how these numbers affect your bottom line, Clarify Capital offers more details about bar profitability and typical expenses.

A classic rookie mistake is getting so caught up in the grand opening that you fail to build a detailed monthly operating budget. That budget is your financial North Star—it tells you exactly how much you need to bring in every single month just to keep the lights on and the doors open.

Decoding Your Pour Cost

Of all your variable costs, none is more critical than your pour cost, which is industry-speak for your Cost of Goods Sold (COGS). This number is simple: it's the cost of your ingredients as a percentage of your sales. In other words, it’s what you pay for the booze in the glass versus what your customer pays you for the finished drink.

For instance, if the spirits and mixers for a cocktail cost you $2 and you sell it for $10, your pour cost for that specific drink is 20% ($2 / $10). The industry benchmark for a healthy, profitable bar is a pour cost somewhere between 18% and 24%. If your number starts creeping higher than that, it's a huge red flag that your profit margins are getting squeezed.

This one number can genuinely make or break your business. It's affected by everything—from bartenders with a heavy hand (over-pouring) and inventory "shrinkage" (theft) to a poorly thought-out pricing strategy. Keeping a close eye on this metric isn't just a good idea; it's essential for survival.

Managing Payroll and Labor Costs

Right after inventory, your people will be your biggest recurring expense. Labor costs—which include everything from salaries and hourly wages to payroll taxes and benefits—should ideally land somewhere between 20% and 30% of your total revenue.

This is a constant balancing act. You absolutely need enough staff on the floor to give great service when you're slammed, but having too many people standing around during slow periods will bleed you dry. Smart scheduling is your best friend here, as is cross-training your team so they can jump into different roles when needed. It's the key to keeping labor costs in check without letting the customer experience suffer.

Other Essential Ongoing Expenses

Beyond booze and payroll, a whole host of other expenses will pop up in your monthly budget. They might seem small on their own, but they add up fast.

- Rent or Mortgage: This is often your biggest fixed cost, usually accounting for 5-10% of your revenue.

- Utilities: Your electricity, gas, water, and internet will typically run you $1,000-$3,000 a month.

- Insurance: Don't even think about skipping this. General liability, liquor liability, and property insurance are non-negotiable.

- Marketing and Promotion: Plan to spend at least 2-5% of your revenue on social media, events, and local ads to keep people coming in.

- Music Licensing: If you want to play music legally, you have to pay for licenses from organizations like ASCAP and BMI. This can cost anywhere from a few hundred to a few thousand dollars a year.

- Maintenance and Repairs: Things break. It’s a fact of life. Set aside a little cash each month for when the ice machine inevitably dies on a busy Friday night.

Getting a handle on these costs, especially your inventory, requires real discipline. Our guide on bar inventory management systems is packed with practical tips on how modern tech can help you track every single drop and protect your profits.

To help you get a clearer picture, here's a breakdown of what a typical monthly budget might look like.

Typical Monthly Operating Costs for a Bar

This table breaks down common recurring expenses, showing their estimated percentage of total monthly revenue. It's a great starting point for new owners trying to forecast their budget.

| Expense Category | Average Monthly Cost | Percentage of Revenue |

|---|---|---|

| Cost of Goods Sold (COGS) | $6,000 - $9,000 | 18% - 24% |

| Labor & Payroll | $7,500 - $11,000 | 20% - 30% |

| Rent / Mortgage | $3,000 - $7,000 | 5% - 10% |

| Utilities | $1,000 - $3,000 | 2% - 5% |

| Marketing | $800 - $2,000 | 2% - 5% |

| Insurance | $400 - $800 | 1% - 2% |

| Repairs & Maintenance | $300 - $700 | 1% - 2% |

| Licenses & Permits | $200 - $500 | < 1% |

| Miscellaneous | $1,000 - $2,500 | 3% - 7% |

Remember, these figures are just averages. Your actual costs will vary based on your location, concept, and size. The key is to build your own budget based on real quotes and solid research, then track your spending against it relentlessly.

Budgeting for Essential Pre-Opening Costs

There's a critical—and often costly—gap between securing your funding and finally opening the doors. This pre-opening phase is where countless hidden expenses ambush new owners, draining cash reserves before a single drink has been sold. Honestly, overlooking these costs is one of the biggest mistakes you can make when calculating the total costs to open a bar.

This whole period is about getting ready for prime time. You're stocking shelves, building your crew, and creating a buzz around town. Every single one of those activities comes with a hefty price tag. A well-thought-out pre-opening budget is what separates a smooth, successful launch from a frantic, last-minute scramble for cash.

Stocking Your Initial Inventory

Before you can pour a drink, you have to buy the bottle. Your initial inventory order is a massive upfront expense, easily running between $20,000 to $50,000, depending on how ambitious your menu is. This isn't just about grabbing a few popular vodkas and whiskeys; it's a complete stock of every single item you'll need.

Think of it like filling a kitchen pantry from absolute scratch. You need everything from top-shelf bourbons and craft beers to obscure liqueurs, wines, fresh juices, house-made syrups, and every garnish you can imagine. This is where your bar’s concept really starts to take shape on the shelves, but it demands a serious cash investment first.

To get a handle on this cost, start by finalizing your beverage menu. That list becomes your shopping guide, stopping you from overspending on niche bottles that will just sit there collecting dust. It also pays to start building good relationships with suppliers early on. They can often provide the latest news on products and exclusive deals, which is a lifesaver when cash flow is tight.

Assembling and Training Your Opening Team

Your staff is the absolute heart and soul of your bar. Building the right team takes time and money—a lot more money than most people budget for. The costs tied to recruiting, hiring, and training are easily underestimated but are non-negotiable for a strong start. These pre-opening labor costs can tack on $5,000 to $15,000 or more to your startup budget.

This part of your budget covers a few key things:

- Recruitment: The cost of posting job ads, attending hiring fairs, and the hours you'll spend interviewing.

- Onboarding: Paying for background checks, getting everyone into the payroll system, and ordering uniforms.

- Training: This is the big one. You'll be paying your new bartenders, servers, and managers for several weeks of training before you're open. This means menu tastings, POS system drills, and full service run-throughs to make sure they're ready for opening night.

A well-trained team is your best marketing asset from day one. Investing in thorough pre-opening training prevents costly mistakes, improves service speed, and creates the kind of positive first impression that turns new customers into regulars. Don't cut corners here.

Pre-Launch Marketing and Grand Opening Buzz

You can build the most incredible bar in the city, but it won't matter if nobody knows it exists. You need a dedicated pre-launch marketing budget to build excitement and guarantee a crowd shows up when you unlock the doors. Plan on spending anywhere from $5,000 to $20,000 on these efforts.

This goes way beyond just hanging a "Grand Opening" banner. A smart pre-launch campaign builds anticipation over weeks, or even months.

Key Pre-Launch Marketing Expenses:

- Digital Presence: Getting a professional website built, creating your social media profiles, and running targeted online ads to reach the right people.

- Public Relations: Hiring a local PR firm or freelancer to get your story featured in local blogs, magazines, and newspapers.

- Opening Events: Hosting a "soft opening" for friends and family or an exclusive preview night for local influencers. This helps generate early buzz and lets you work out any operational kinks before the real rush.

The Ultimate Safety Net: Working Capital

Last, but certainly not least, is working capital. This is the cash reserve you absolutely must have on hand to cover all your operating expenses for the first three to six months. It’s your financial cushion, designed to keep the lights on while you work on building a steady stream of revenue. Most lenders will want to see you have $50,000 to $100,000 (or more) set aside specifically for this.

Working capital is what pays your rent, payroll, utilities, and inventory re-orders until your bar is profitable. Not having enough working capital is one of the main reasons new bars fail. No matter how packed you are on opening night, it takes time to build a consistent customer base. This reserve gives you the breathing room to get there without stressing about every single bill.

To help your budget stretch further, look for ways to lower your fixed costs from the start. For example, learning some effective lease negotiation tips can help reduce what is likely to be one of your biggest monthly expenses.

Got Questions About Bar Opening Costs? We've Got Answers.

Alright, we’ve crunched a lot of numbers—from the big-ticket items down to the month-to-month grind. But even with a solid plan, specific questions always pop up. It's only natural.

Let's tackle some of the most common ones we hear from people just like you, trying to turn their dream bar into a reality. Think of this as the final checklist to sharpen your budget and sidestep those expensive rookie mistakes.

How Much Cash Do I Really Need for a Bar Loan Down Payment?

When you walk into a bank, they want to see you have some skin in the game. It's not just about their risk; it's about your commitment. For most lenders, including those backing SBA loans, you'll need to bring a down payment of 10% to 30% of the total project cost.

So, if your bar has a startup price tag of $480,000, you’re looking at needing between $48,000 and $144,000 in cash upfront. Putting more money down isn't just about getting a 'yes' from the bank—it often lands you a better interest rate, which saves you a ton of money over the long haul. And remember, this is completely separate from the cash you need to actually run the place for the first few months.

What’s the One Cost Everyone Forgets to Budget For?

Hands down, it's working capital. It's the silent killer of so many new bars. Aspiring owners get laser-focused on the tangible stuff—the cool bar top, the shiny new POS system, the construction—and completely misjudge how much cash it takes to just keep the lights on.

We're talking about the money you need to cover payroll, rent, utilities, and restocking your inventory for the first three to six months before you're actually making a profit. Running out of operating cash is a classic, and tragic, reason why great bar concepts fail.

Underestimating your working capital is like planning a cross-country road trip but only budgeting for enough gas to get out of your neighborhood. You need enough fuel in the tank to cover the entire journey, not just the start.

Can I Save Money by Buying an Existing Bar?

Absolutely. Buying a turnkey bar can be a shortcut that saves you a mountain of cash and headaches. You sidestep the chaos of construction, the high cost of brand-new equipment, and the soul-crushing bureaucracy of getting a new liquor license (which can often be transferred).

But—and this is a big but—you have to do your homework. Dig deep to find out why the owner is selling. Are you inheriting a bad reputation? Equipment that’s one breakdown away from the scrapyard? A nightmare lease with hidden clauses? A cheap price tag upfront could mean you're just buying someone else's expensive problems.

How Long Until My New Bar Actually Makes Money?

There’s no magic number, but most new bars start turning a profit somewhere between 18 and 30 months. That window can swing wildly based on a few key things: how much debt you started with, your location, how well you get the word out, and how tight a ship you run.

A spot in a bustling downtown area might hit its stride faster than a neighborhood joint with high rent. Getting a death grip on your labor and pour costs from day one is the single best thing you can do to shrink that timeline and start seeing green.

Building your dream bar takes more than just a vision—it takes careful planning and the right partners. At Encore Seattle Restaurant Equipment, we help restaurant owners and chefs discover the latest news and exclusive deals on restaurant equipment and supplies. From walk-in coolers to the perfect glassware, we have what you need to build a bar that lasts. Explore our inventory and find exclusive deals to get started.